OkCredit, one of the most trusted mobile apps for small businesses across India, relies on Mixpanel to increase user engagement and long-term retention.

We require every new PM to learn how to use Mixpanel; it’s a critical tool for understanding our users. Without Mixpanel, everything would just stop.Vishesh Patni Product Engineer, OkCredit

Company

In 2017, micro and small business owners in India were relying on a mix of registers and boxes of scribbled bills to track their balances. Harsh Pokharna, Gaurav Kumar, and Aditya Prasad decided to create the first version of OkCredit so their local grocery store owner could better track customers’ lines of credit.

At first, the grocer was reluctant, but quickly swayed by the app’s speed, organization, and accuracy. After a brief trial run, the grocer migrated his entire clientele from a hand-written notebook to this digital platform. The grocer told Gaurav he was “amazed by the experience,” and customers showered the grocer with compliments for “adopting such a smart solution.” They also said their business relationship felt more trustworthy, thanks to the real-time alerts customers received following every transaction. It reminded them of bank transactions.

The grocer also promoted the app to other business owners. OkCredit has been gaining users to the tune of roughly 300,000 installs per month ever since, and is now one of the most trusted and loved mobile apps for small business owners. The app has more than ten million downloads across nearly 2,000+ cities in India with its popularity being driven by strong word of mouth and network effects.

Goals

“We’ve had one of the steepest growths in user acquisition for B2B companies in India,” said Vishesh Patni, Product Engineer. “Our goal is to help users engage more with our app and ultimately help them become long-term retained customers.”

OkCredit teams rely on Mixpanel to measure how users are engaging with the app, which features customers are using, and how much they are engaging with the app overall.

Solution

Improving new features

Something you learn pretty early in business is that the cost of retaining customers is a fraction of the cost of acquiring new customers. Of course, for a startup, you need to have customers before you can start crafting a retention strategy. And since OkCredit was acquiring new users at breakneck speed, the team decided to identify more problematic metrics. For example, Mixpanel showed that most users were not clicking on the “send reminder” button that was part of a new feature, something which makes the app useful and sticky.

“We experimented with adding a red dot on the button,” said Vishesh. “It was a very minimal tweak, but it did a good job of attracting users’ attention. We saw a 40% increase in first-time adoption of the ‘send reminder’ feature.”

Focusing on growth

Despite the company’s impressive growth, OkCredit was not available to a large percentage of the population. Many English language apps are designed for mobile-first millennials in India’s largest urban centers—not users in smaller cities (known as Tier II, III, and IV cities) and non-urban centers. Vishesh used Mixpanel to determine that OkCredit was popular with non-Tier I cohorts and users in these groups just happened to greatly outnumber those in Tier 1 populations.

When OkCredit releases a new feature, teams use Mixpanel to track how many users are sampling the feature and if it’s impacting their overall customer retention. “We love how Mixpanel allows us to create cohorts from anywhere on the platform and then understand their growth over time,” said Vishesh. “It helps us focus on retention.”

Results

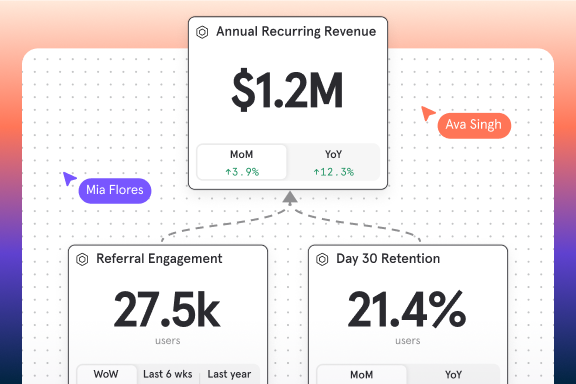

OkCredit has been using Mixpanel since the beginning. It played a critical role in the company becoming product-focused and deliberate about solving complex problems. “Mixpanel has been integral for tracking how our product is doing,” said Vishesh. “We use our Dashboards to track all our KPIs across product, marketing, and analytics teams, such as active merchants, app engagement, and retention.”

OkCredit uses several different Mixpanel features, including Insights, Funnels, Cohorts, Retention, and Data Pipelines. “The quick integration saves us a lot of time,” said Vishesh. “We require every new PM to learn how to use Mixpanel. It’s a critical tool for understanding our users,” said Vishesh. “Without Mixpanel, everything would just stop.”