Why (and how) we revamped our equity program

Until today, employee equity at Mixpanel worked like it does at most other startups—which is to say, imperfectly.

Today we are announcing a major change to our equity program: we’ve extended the post-termination option exercise window from the standard 90 days to five years for employees who join Mixpanel and stay at least two years.

This change is meant to help employees reap the rewards of their work at Mixpanel. Stock options are big part of our overall compensation package, but some nuances of how they traditionally work can make it difficult for someone to actually purchase that stock, if they choose to leave the company.

We didn’t make this decision lightly. There are some obvious benefits to employees with this change, but we did our research and made a calculated decision. It is our strong belief that this is the right thing both for our employees and for our company in the long term.

This post will discuss the process we went through to make this decision and implement the change. It has two purposes:

- I’m very proud that we’ve made this decision–so of course I want to tell the world.

- But more importantly, we believe this is a change more companies should make. It’s a difficult decision that is made more difficult the larger the company. At 235 people, Mixpanel is one of the larger companies to implement this change. But by putting this out there, I hope we can help more companies learn about the process and make the decision to do right by their employees and extend their option exercise period.

As a companion to this post, we’ve also decided to open-source the deck we used internally to pitch the new equity plan to our executives and board.

The problem with a 90-day exercise window

I’ll describe the problem only briefly, since it’s been described well on numerous occasions by people like Sam Altman of Y Combinator and Adam D’Angelo of Quora.

In most tech companies, employees receive stock options as part of their compensation. Options give an employee the ability to purchase stock from the company at a fixed price, set to the fair market value at the time the options were granted.

So an employee actually has to pay money to get their stock. At a private company, this can be difficult to do for a number of reasons:

- It can be financially risky—if the employee buys their stock and the company is not successful, they lose their money

- It can be quite expensive to acquire the stock, depending on the value of the company when the stock was granted

- Once the stock is purchased, the employee may immediately owe taxes on a significant amount of “paper” income (the difference in fair market value today from the amount they paid to acquire the stock)

So in order to avoid financial risk, employees often make the decision to hold off on exercising their options until it makes financial sense.

However, in most companies the ability to exercise stock options expires 90 days after the employee leaves. This means many people leave without purchasing their stock—often leaving a lot of money on the table. Or it means employees feel stuck.

With tech companies, including us, taking longer to go public, we understand that early employees might want to go someplace else or do something else over time, and we want to enable that without tying them down.

This is the status quo, but it doesn’t have to be.

That’s why we asked Justin Lau, our VP of Legal, to research our options and make a recommendation of what employee equity approach made the most sense and was the most fair.

He spoke with representatives at various companies who have moved to a longer exercise window, including Pinterest, Coinbase, Square and Quora. They talked about what went into each company’s decision, how it was executed, and what the positive and negative outcomes were so that Mixpanel could better understand what it would mean for our company and employees.

Arguments for and against the status quo

There are two primary arguments for sticking to the 90 day exercise window:

- Employee retention: Traditionally, the high cost of and short time frame to exercise options is viewed as a good thing—something that helps with employee retention. Because employees can’t afford to purchase their stock (which may be worth quite a lot of money), they have “golden handcuffs” and won’t leave until the company goes public or is acquired.

- Stock recapture reduces dilution: When employees do choose to leave and forfeit their options, those options return to the option pool and can be granted to another employee (or new hire, to replace the person leaving).

The status quo tends to primarily benefit existing stockholders (founders, investors, very early employees), and employees who are still with the company when it exits.

Andreessen Horowitz has written about the unintended consequences of extending the option exercise window, as well as their recommendations for mitigating those consequences. Both are worth reading and evaluating in the context of your company. Triplebyte has done a fairly thorough takedown of a few other arguments, which is also worth reading if you’re thinking about this.

There are a few arguments in favor of extending the exercise window significantly:

- Fairness: Stock options are part of an employee’s compensation, and a short exercise window often prevents them from actually receiving that compensation. It disproportionately rewards employees who have the means to assume the risk and execute stock options. Extending the exercise window makes it possible for many more people to reap the rewards of the hard work they put into building this company.

- Removing the cuffs: The flip side of employee retention: retaining the right people. We have no interest in golden handcuffs; we want everyone here because they want to be, not because they can’t afford to leave. We have a lot of work to do, and that work will be a lot harder with people who are just putting in time.

- Quality of life: It gives our employees peace of mind. Equity is an anxiety-inducing topic. There is an opportunity cost to working at company when employees don’t believe like they can exercise their options. They feel like they are not getting the full compensation for their employment. We don’t want employees worrying about how to pay for their stock or feeling trapped.

Where we landed

As you can see, these arguments give you four primary factors to consider as you make your decision:

- Fairness

- Dilution

- Retention

- Quality of life

The first two are in direct opposition—it’s fair to give people more time to buy the stock that they earned, but the typically short exercise window reduces dilution for everyone else. In this case, we chose to prioritize fairness over dilution mitigation, largely because we believe the right way to address dilution is to hire the right people in the first place.

Retention is its own whole issue with multiple factors that exist outside this conversation. Companies have to take a philosophical stance. Do we want to keep everyone, even if they don’t want to be here? We decided we don’t. We want our employees to want to be here. Forcing them to stay results in misaligned incentives: they are incentivized to keep their head down and not take risks. But if we want to continue to be successful, we need to keep taking risks.

We believe our equity is meaningful, and if everyone at Mixpanel believes that as well, we will all work hard, take risks, and strive to make Mixpanel a better, more successful company.

And lastly, extending the exercise window was a clear win for our employees’ quality of life. This is something that people are thinking about, and we understand that. But we don’t want them to be concerned about how and when they’ll need to exercise their options. An extended window gives our people one less thing to worry about. Everyone’s busy, everyone has a lot going on; removing unnecessary stressors is one of the best things we can do to help our people be happier and more effective.

How we made it happen

Based on all this information, Justin proposed a five-year exercise window for employees who work at Mixpanel for at least two years. It’s a balanced approach that’s fair and rewards employees for their time at Mixpanel. It was first discussed at the executive level and then the board level. Once we were all in agreement that this was a better option for our company and employees, and we had board approval, we began the process of making the change.

After the decision was made, we leaned heavily on our legal and finance team to facilitate the execution. The scale of this project will correlate with the scale of your company. For younger, smaller companies, this may not be as much of a consideration in process. A change like this requires each and every employee to make an individual choice whether to accept the longer exercise window and exchange their option.

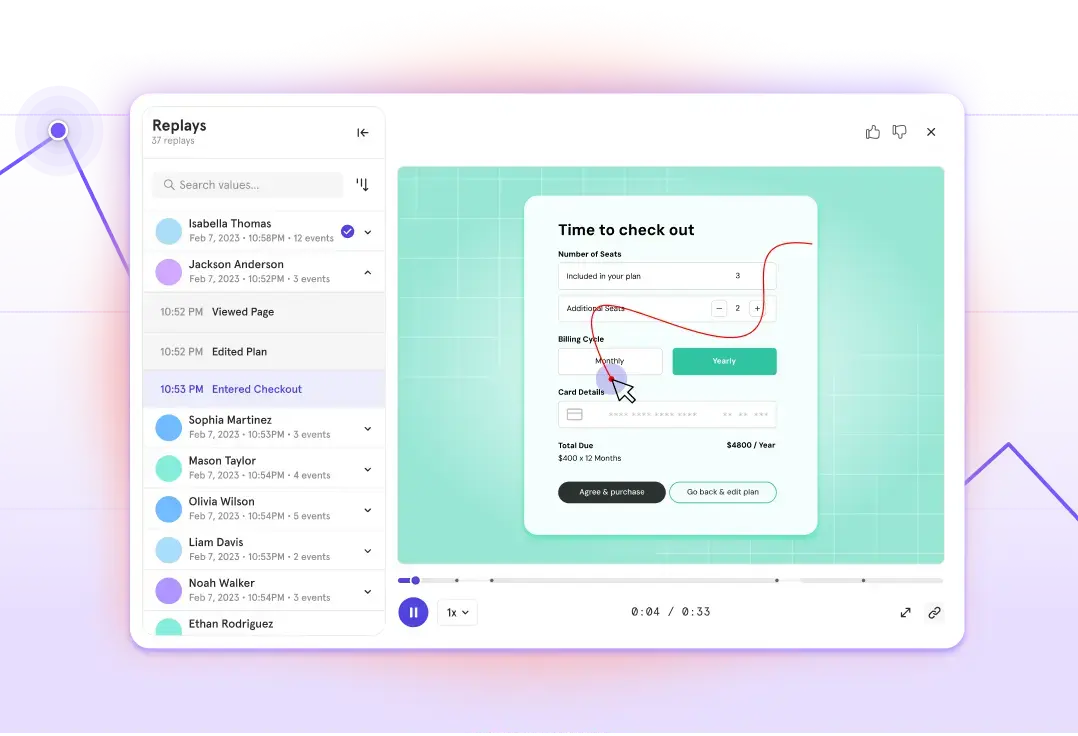

To aid in the transaction, we made the decision at Mixpanel to migrate to an equity management platform called eShares, and we were happy we did. eShares not only allows us to automate complex and otherwise manual transactions like issuing options and processing option exercises, but we were also able to effect the tender offer to our employees to implement the new PTE period for their options.

The platform required some customization, largely driven by our legal team working closely with their product and account management teams, but it was worth it, and eShares was very helpful in ensuring things went smoothly.

One of the most important steps for us was communicating to our employees why we were making this change and what it would mean for them, so they could make an informed decision. We took time out of our all-hands meeting to have Justin walk-through the decision and explain the elements of the offer. This, along with the information provided via the eShares platform, allowed each employee to evaluate their situation, research both options, and make the decision over whether to opt into the new program.

Feedback so far

So far the feedback from the team, as expected, has been universally positive. The thing that has resonated most is the idea that we want people who want to be here. That’s true for the executive team, but it’s at least as true, if not truer, for everyone else. Everyone wants to work on a team where everyone is deeply engaged in what they’re doing—and this is a step that helps move us closer to that ideal.

If your company is thinking about making the same decision, we’re happy to talk through our process in more detail – just email equity@mixpanel.com.