Why crypto startups need (secure) product analytics

All startups should be using product analytics to understand their users and build products and features that their users love. But if you’re a crypto startup, like an exchange or an NFT marketplace, you’re competing to keep up with the breakneck pace of today’s blockchain technology boom (there are now 19,000 different cryptocurrencies traded publicly, for example), and that means the advantages that product analytics insights offer can become even more important.

In other words, crypto startups don’t just need product analytics to point out which features or campaigns are converting and retaining the most users—they need sophisticated data and analysis on things like what myriad transaction combinations users are interested in pulling the trigger on once they do convert. Not to mention, considering the FinTech nature of most activity happening in this space, these companies want to get all of the above as securely as possible for themselves and their customers.

At Mixpanel, we’ve gained a lot of experience in working with crypto customers. So in this blog, we’ll dive into the details, with examples, of how crypto startups, specifically, can and should leverage powerful and secure self-serve product analytics.

What makes a 'crypto startup'?

If you’ve read this far, we’re going to assume you know a thing or two about cryptocurrency and the underlying blockchain technology that makes it go. For us, any startup offering core products that rely on these technologies falls into the “crypto startup” category.

Some popular Web 3.0 and crypto startup examples include:

OTC exchanges: These companies can be seen as the onramps from traditional finance to cryptocurrencies. In other words, users can connect their bank accounts, go through somewhat traditional finance user signup processes, and buy and sell cryptocurrencies.

P2P applications: Rather than using an order book to pair buy-and-sell orders and control the platform’s assets, there are companies that create apps where users can privately exchange crypto with one another without the use of an intermediary, such as a bank.

NFT platforms: These are marketplaces where users can buy and sell digitally unique items (e.g., trading cards, video clips, digital art, that all have an encrypted digital signature) in a peer-to-peer way.

Digital wallets: Even though transactions can be public, access to crypto assets remains private thanks to encryption keys. Wallet applications can be used to store these keys digitally for customers to control their digital assets in a “non-custodial” way.

Product analytics for crypto startups

Again, like any other startup, without the ability to experiment quickly with self-serve analysis (as opposed to requesting complex SQL queries from your data team), crypto startups are not able to adequately define and measure “aha” moments for customers. These “aha” moments are crucial to activating your users and priming them to become happy, long-term retained users.

But it’s the often complex kind of “aha” moment, and the sensitive data around it, that makes product analytics for crypto startups a different animal.

Keep privacy #1 with anonymous user cohorts

In a world of “censorship-resistant digital assets” and “permission-less transactions,” crypto or blockchain applications highly value privacy. For instance, since many blockchains are public ledgers, it is important not to store transaction amounts and timestamps together in one user profile with personally identifiable information (PII) because a bad actor could, in theory, identify a user’s wallet address from this information.

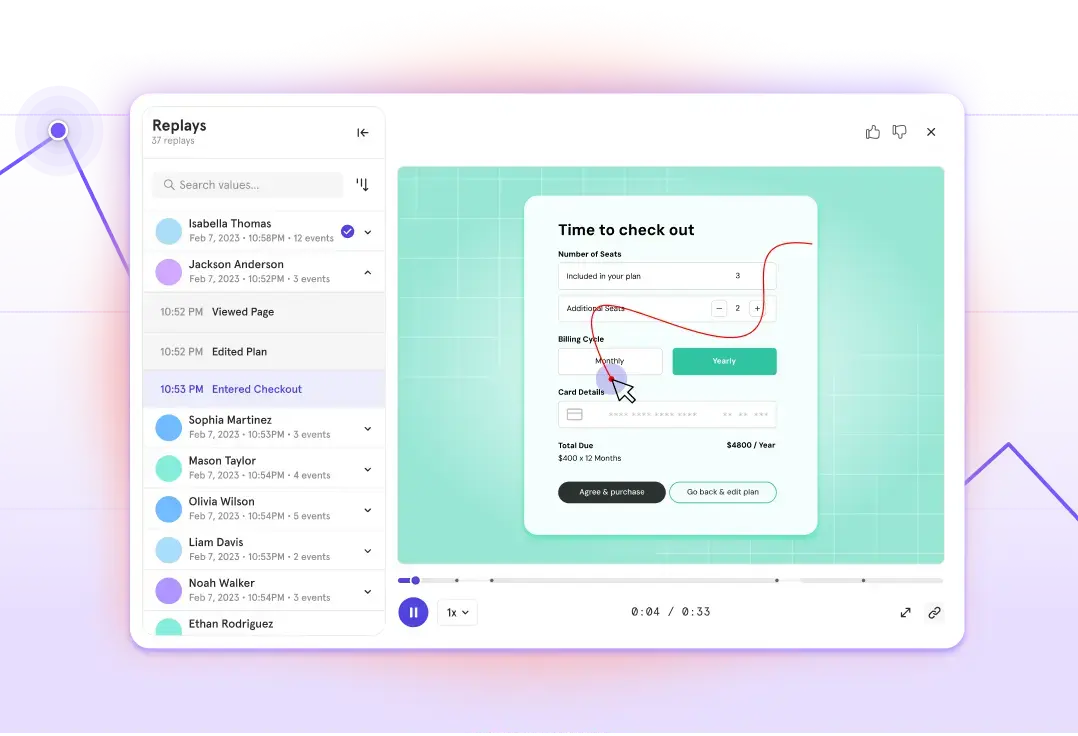

- With product analytics, teams can safely track users anonymously while still analyzing cohorts of users and how they convert or retain through various scenarios based on their behaviors.

- This protects the user while still allowing engineering, product, growth, and design teams to understand what makes a user find value on the platform.

Make crypto’s (very hard) customer activation easier

Onboarding new users can be a nightmare for crypto startups given the requirements for what user information is needed. Typically, things like a social security number and other forms of identification have to be submitted in addition to a laundry list of other anti-money laundering (AML) checks. The answer for most companies: Try a bunch of different signup flows and other solutions—like know your customer (KYC) tools—to make the process better for customers. With product analytics, it becomes faster and easier to figure out what’s actually working.

The user events and properties recorded in Mixpanel can be used in A/B testing to understand which KYC provider or which onboarding flow option truly provides the best onboarding experience.

Analyze volatility faster

In an environment ripe with phishing attacks, high-profile hacks, or even viral attention, crypto companies (from exchanges to wallet apps) can make great use of product analytics to help identify and act on the most challenging kind of activity anomalies detected from their metrics.

Analyzing spikes for patterns that would indicate inauthentic traffic can help companies avoid flaunting vanity metrics that don’t reflect their true user base. And for exchanges, insights attained in Mixpanel could also be used to set velocity rules in the company’s risk engine. These can help identify suspect bank identification numbers (BINs) and the frequency of transactions that would cause AML concerns. An example of how risk scoring works can be found here.

Keep users engaged while they HODL

With how quickly the crypto markets can turn in sentiment, monitoring user life cycles and engagement is imperative. This can sound tricky since a popular crypto persona could be someone who buys an asset and holds on (or HODLs). But does a set-it-and-forget-it, long-game crypto investor always have to mean an intermittent user? Some platforms have experimented with interest-earning programs to keep users’ attention through all the bear and bull runs, and product analytics is key for understanding how a feature like that might be helping users stay retained once they activate and engage.

Being able to define and observe lifecycle cohorts that are specific to the technology platform a company lives in allows product teams to more accurately gauge performance.

Easily adjust to the fast-evolving regulatory landscape

With an ever-changing regulatory environment in the crypto industry, having an analytics tool that can accommodate some of the most stringent verticals, from a compliance standpoint, can help ensure your users are protected conservatively as the requirements change. For example, Mixpanel has GDPR capabilities to delete user data upon request as well as options for EU data residency. Additionally, companies with highly sensitive data, such as healthcare companies, are able to build winning products based on the experience of the user—all without compromising privacy and remaining HIPAA compliant by signing a BAA with Mixpanel.

Get complex user behavior questions answered—fast

Finally, here are some key questions that crypto companies are answering with Mixpanel to stay on top of trends that they observe in their users:

- What are the most popular trading pairs day over day, week over week, and month over month (BTC/USD vs. BTC/ETH vs. DOGE/USD vs. BTC/USDC)?

- What campaigns work best at increasing the frequency and value of trades (e.g., cashback vs. discounted processing fees vs. a reward program)?

- How many trades per user per week do our power users execute?

- What % of users are active traders vs. long-term HODLers?

- What are acceptance rates for debit cards / bank connections / APM (alternative payment model) payments?

- Related to the last point, what are the most common decline reasons (e.g., timeout on the UI, insufficient funds, or sometimes even delays in the back-end payment processing)?

- What % of signups are coming from fraudulent users?

- How fast are users getting to values (e.g., connecting a hardware wallet, performing their first payment activity, or depositing funds from an outside wallet)?

All in all, when working with potentially paradigm-shifting technologies that move even faster than the haste of a typical startup environment, there are going to be user nuances that apply to this unpredictable, but exciting, new segment of tech. That is, if you’re building a metaverse Web 3.0 app on the blockchain, you’re going to want to make use of all the data and analytics help you can get.

With privacy and empowerment of the user at the forefront in the crypto space, startups can utilize product analytics to keep users engaged and retained by learning how to build features beyond simply buying and HODLing, by reacting quickly to the regulatory landscape, and by getting simple answers to their powerful user behavior questions answered at ⚡️speed.