ATB Financial improves conversion and engagement of products using Mixpanel insights

Company

With $58.5 billion in assets, ATB Financial is an Alberta-built financial institution that is a catalyst for economic growth. Started in 1938 to help Albertans through tough economic times, today ATB Financial has more than 5,000 team members delivering exceptional experiences to nearly 800,000 clients through its branches and agencies, 24-hour Client Care Centre, four entrepreneur centres, and digital banking options.

Challenge

ATB Financial has a suite of eight separate digital products, many of which were being migrated from a legacy platform to a modern banking platform. Transitioning from legacy platforms meant ATB could begin product analytics to gain a better understanding of how users behave within its various products. They relied on anecdotal evidence and Google Analytics, and neither could offer the detailed understanding of different user cohorts which the bank needed to build winning products. They needed a product analytics solution to improve user insight for retention and conversion, and to support several high profile platform migrations.

Solution

ATB selected Mixpanel to continue its digital transformation with a powerful tool that could support a data-informed culture, while meeting the company’s strict data governance requirements. Using Mixpanel, the company has been able to easily combine its product insights with its own data warehouse using cost-effective data pipelines. Mixpanel’s ease of use has led to growth in self-serve analytics across teams and provided an overall boost to data literacy.

The company has gradually rolled out Mixpanel across its product teams so everyone can understand why users take specific actions. Those insights have provided the confidence to improve user sign-up flows, sunset older versions of products, appropriately staff contact centers, and deliver better user experiences and to complete critical migrations in a way that meets the needs of ATB’s users.

Mixpanel allows us to advance the overall data conversation in our organization, because we’re able to have a more granular view of what users are doing, and importantly, why they’re doing it.Jaryd Zinkewich Director, Strategic Insights and Decision Support, ATB Financial

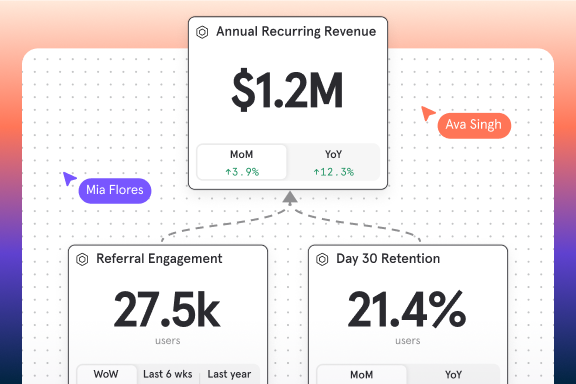

Results

- 5% improvement in conversion rate for digital banking sign-up

- Self-serve analytics by product managers saved several data analysts at least one day per month in manual work

- Prevented churn from high value clients, saving an estimated $120k/month in operating revenue

- Discovery of 13% increase in users choosing the new ATB Personal banking product helped ATB speed up migration to avoid a penalty from a legacy platform vendor

- Increased mobile engagement from 31% to 44% with new ATB Personal banking product

- 120 active users in Mixpanel and 842 reports created in the first year of using Mixpanel

How they did it

How did you evaluate tools on the market?

We conducted a thorough evaluation of all the main tools that would come to mind when you think of product analytics. We did this in a structured way, by first identifying all the various problems our eight product teams experienced day-to-day, before assessing each tool against them. It was a stringent process and Mixpanel came out on top.

Why did you choose Mixpanel?

We chose Mixpanel for its best-in-class product analytics, combined with flexibility. It’s easy-to-use and powerful at the same time. But there were essentially three deciding factors:

- With Mixpanel, you can really own your data. We ingest the data into our own environment and we can cross reference it with other data we hold. We’re free to build our own stack.

- We’re a bank so we have very stringent data governance and security. Those teams were impressed with the control Mixpanel gave us. We could ensure we only tracked the events we legitimately needed to in order to meet our goals.

- Through a company that ATB had recently spun-off, we had already seen Mixpanel deliver results. When working with Mixpanel’s Customer Success team, we always got the sense it was our objectives that mattered. We always felt well-supported.

If you’re going through the evaluation process, our advice is to focus on the Customer Success team and making sure they align with your organization’s values and speed. Hands-down, that’s why we’re successful with Mixpanel. They are a true partner to us, and we greatly value their advice and strategic guidance.

How did you approach the implementation of Mixpanel?

We took a phased approach and moved each of our eight product teams individually. We did it this way so each team could share learnings with the other teams, and we quickly built a strong understanding. Our product operations team oversaw this, helping to guide each implementation and ensuring we had buy-in from product leads, product managers and engineers. Each engineer knew why they were tagging different events which meant it wasn’t abstract work, and they had a stake in our success. This was key to a smooth transition.

Mixpanel is easy to use. That frees analyst resources by enabling self-service by all our teams. Self-serve is boosting data literacy across ATB. That’s hugely valuable.Adrian Leung Product Operations Manager, ATB Financial

How do you democratize data at ATB?

There are a number of teams that need product insights, from product to research to marketing and even our customer success teams in branches. The great value of Mixpanel is its ease of use. Even if a colleague doesn’t have strong data skills, he/she can still self-serve to answer basic questions with Mixpanel. That’s a virtuous circle because they then build the skills to ask more complex questions to our analysts, so we actually see Mixpanel as a really important way of building data literacy across the organization.

That’s great, and has that data literacy improvement saved your team time?

It’s hard to quantify because we’re not sure how many questions teams have been able to self-serve without us. But before Mixpanel, there was a specific batch of questions from product managers, and those would take each of our analysts at least a day each month to work through. Now those teams are able to self-serve, so at a minimum, that’s saving several highly-skilled analysts approximately one day per month.

How has Mixpanel helped you manage data at ATB?

There are three key examples we’d like to cite here:

- The data is in our own environment, which means we can understand the actions users take before they do anything substantial like making a transaction. That happens in our environment, which is crucial because we wouldn’t be able to send that to a third party.

- Mixpanel supports our data stack. We can easily ingest data using Mixpanel and send it to our own data warehouse using pipelines. Those pipelines are cost-effective and easy to establish.

- We’re able to visualize data across the entire company. We don’t need to worry about buying seats for people that only consume visualizations. As an analytics team this means we can just let product teams move forward, we don’t need to worry about exceeding our seat licenses.

How has Mixpanel helped you prioritize your product roadmap?

We use Mixpanel to understand which user behaviors most impact retention in terms of reach and impact so we can focus resources on improving those specific experiences. More specifically, we were able to see the features that our customers tried to access via the web using mobile. That gave us the insight to prioritize the features we wanted to build into our app.

We’ve had a few major platform migrations, and Mixpanel has helped us understand how to complete them in ways that support the users’ transition and retention. It even helps us plan how to staff our contact centers at these crucial moments.Samantha Poon Digital Product Coach, ATB Financial

Tell us how Mixpanel has delivered business value and influenced specific product decisions.

Two great examples come to mind:

1. ATB Business Banking product

Our Business Banking product was moving to a new platform but customers still had a ‘return to classic’ option they could select upon logging in. We used Mixpanel to see how many, and which user groups were returning to classic, so we could engage with them and encourage adoption of the new platform. In fact, we discovered that 10-12% of users were returning to the classic option and we identified 1575 highly impacted users by using a funnel report to see quick conversions to the old site upon logging in. This behavior indicated that this cohort was not finding features they needed in the new experience. This knowledge led us to postpone the removal of the ‘return to classic’ button by several sprints until we were able to rollout the feature they needed.

In this Business Banking example, we prevented churn from high value clients (estimated at $120k/month in operating revenue) by:

- Contacting these identified clients via the sales team to identify missing features and support them through the transition. It’s important to note that we would not have been able to identify these clients without Mixpanel. It was more than just the product team rallying behind the Mixpanel data.

- Delaying the removal of the button to add missing features to the new platform before removing the option to go back

- Staffing extra agents in our call center to prevent higher wait times in anticipation of unseen issues

2. ATB Personal Banking product

We saw similar success using Mixpanel insights with our Personal Banking product, updating our mobile and web platforms to the new ATB Personal experience. These are major platform migrations, and we needed to ensure a smooth conversion to the new channels. In one incident, we identified that people who completed the beta sign-up didn’t notice they could access the new version straightaway. When we addressed that with a UX fix, we saw approximately 13% increase in users accessing the new beta platform immediately. This was hugely valuable because we were facing a penalty from a vendor if we didn’t manage to retire the old platform in time.

In addition, since the launch of ATB Personal at the end of March 2021, mobile engagement has increased from 31% to 44%. Clients are engaging with the mobile experience on average 14 days a month, up from an average of 10 days a month.

For both migrations, we used insights from Mixpanel to predict the number of contact center colleagues we needed on hand to support customers during the actual migrations. That kept call center queues down and customer satisfaction up.

Has Mixpanel helped with conversion too?

Yes, especially for ATB Grow, our platform that allows customers to open bank accounts online. We used Mixpanel to analyze the sign-up flow, which includes an identity verification stage. We found lots of users dropping off at this point and we were able to understand what was driving that. It was a relatively quick fix, which led to an improvement in conversion of around 5%, which is huge for us.

Mixpanel uncovers questions that exist, while also uncovering the questions we didn’t know existed. We’re now asking better questions, and these data-informed questions allow us to be smarter about all aspects of our business.Jaryd Zinkewich Director, Strategic Insights and Decision Support, ATB Financial

What other insights have you surfaced with Mixpanel?

Our ATB Unleashed product is used by our colleagues in conjunction with SAP CRM. We wanted to decommission support for Internet Explorer (IE) to free resources, but we didn’t understand how many colleagues still relied on IE. Using Mixpanel, we found it was as high as 29% of business users, and we were able to understand why they favored IE. This helped us run a communication program to encourage a switch to Google Chrome and ultimately retire support for IE.

As you look ahead to the future, how will Mixpanel help you get there?

We see Mixpanel as a key partner in continuing to help us mature our product analytics practice through product operations. Mixpanel will allow us to continue building in maturity skills around experimentation, around data-informed decision-making, and around trade-off conversations. Doing so will enable our teams to do a deeper dive of analysis into opportunities that we feel may exist in the future to inform our roadmaps through analysis. We see Mixpanel continuing to help us scale to the rest of the organization so we can continue to use one central point for conversations around client behavior data. This will ultimately help us better target the different efforts we’re doing in research, for example, so we’re laser-focused and can measure what matters.

Thousands of companies use Mixpanel to build better products. See what Mixpanel can do for your team. Create your free account today.