Mobile-first banking app, Brightside, increases new account opens by 30% in less than six months with Mixpanel.

Company

Based in Alberta, Canada, Brightside is an all-digital, mobile-first banking app that is part of ATB Financial, the largest Alberta-based financial institution with $54.3 billion in assets. ATB has over 5,500 employees with a total of 315 branches and agencies, and provides financial services to over 775,000 Albertans and Alberta-based businesses.

Brightside was launched by ATB as a challenger banking initiative that would provide an opportunity to reinvent their operating model and enhance their digital capabilities. The company’s mission is to help more people improve their financial health with a mobile banking experience that makes saving easy and fun. With the Brightside mobile app, for example, users can round up their purchases and automatically transfer the remainder to a savings account.

Scott Cormier is the Growth Lead at Brightside. “For many who are living paycheck to paycheck, even an expense of a few hundred dollars can cause serious stress. We want to increase people’s confidence by helping them realize they have more control over their money than previously thought,” he said.

As a challenger bank initiative, Brightside hews more closely to a startup in terms of day-to-day operations. “It’s imperative that our team can learn from our data so we can iterate quickly and and build the best product,” said Scott. “I’ve used Mixpanel at a variety of companies since 2012; the value of product analytics is massive in terms of allowing teams to make faster decisions.”

“Although we have access to tremendous resources within ATB, the concept of behaviour analytics is very new and our analysts are focused on more traditional BI efforts. On top of that, it could take weeks to pull the reports that we need,” said Scott. “Mixpanel has completely shifted our company mindset. We’ve gone from, ‘There’s no way we can possibly know this,’ to ‘Oh, maybe we do have that information. Let’s check in Mixpanel.’”

As a challenger bank, we operate more like a startup than a traditional financial institution, so being able to prove quick wins is critical to our success. In a short period of time, Mixpanel really helped us move the needle on the number of users who could open new accounts online, providing us with a strong foundation to move forward.Scott Cormier Growth Lead, Brightside

Challenge

One of the first things that the team at Brightside worked on was the new account open process (allowing new customers to open an account online.)

“In order to open a new account, most Canadians still need to visit a bank in-person, which can be an inconvenient and time-consuming process,” said Scott. “With Brightside, we tried to design our process so that you could open a new account online in two minutes or less.”

The team built an early proof of concept to test out the process, recruiting a few hundred ATB employees as alpha testers. Brightside’s goal was to achieve a 70% or higher completion rate for new account opens. “We aimed for 70% because we knew there was a segment of the population that didn’t fit the regulations of the credit agency bodies and wouldn’t be able to open an account,” said Scott.

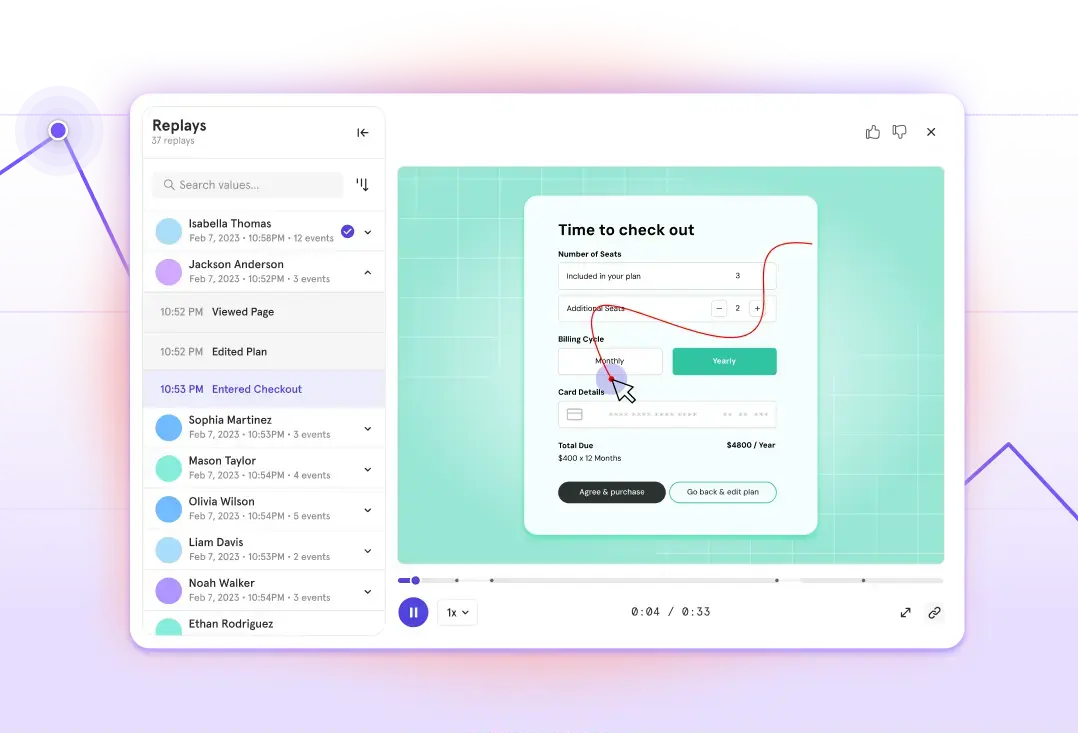

With Mixpanel’s Funnels report, Scott and team were able to study how users went through the account open process from beginning to end, consisting of the following steps:

- Account open started

- Personal information completed

- Mobile verification completed

- Regulatory questions completed

- Account open success

Unfortunately, the team found that only 50% of the alpha group was able to complete the process. “Brightside is limited to serving the province of Alberta, which means we have a smaller addressable market than most. We have to make it as easy as possible for anyone who shows interest to open an account. Every company wants to optimize their conversion rates, but in our case, there’s little room for error,” said Scott.

Solution

Narrowing in on their target market

“With the Funnels report, we could see which steps were causing the most significant drop-offs in our account open flow,” said Scott. “We saw that it was in the Personal Information step and needed to narrow in on the exact issue. After working with our support team and conducting user interviews, we realized that it was address-related: people with PO boxes and rural addresses could not open accounts.”

The team had initially hypothesized that their target market would be more urban. By seeing in Mixpanel that rural users had a harder time signing up, this helped reinforce their decision to focus on large cities within Alberta. They also updated their messaging to reflect that people with PO boxes and rural addresses would be unable to sign up. With these changes, Scott and team increased conversion rates for new account opens to 85%—an increase of 30% in less than six months.

“Banks tend to move more slowly, so being able to move the needle in under six months was huge for us,” added Scott.

Reducing user verification costs

Part of the new account open process involved a user verification step with a third-party vendor for electronic identity verification, yielding 50-55% success rates. Scott and team had found another vendor that provided verification via photo IDs that was significantly more affordable and wondered if utilizing them would yield the same conversion rate.

“After providing both authentication options to users, we saw in Mixpanel that the photo ID method was just as successful. As a result, we decided to still offer both methods to users, but redesigned the UI to make the photo ID verification option more prominent. This was a win-win: we reduced our costs by 55% while still maintaining the same conversion rates,” said Scott.

Why Brightside loves Mixpanel

Accelerating business impact with Professional Services

“Mixpanel’s Professional Services team provided us with the support we needed to be successful with product analytics out of the gate. They helped us plan a healthy implementation, setting up a strong foundation to answer any questions we have in the future. We also have our own Slack channel with the Mixpanel team and I encourage everyone on our product team to join and ask questions.

The Professional Services team also shared best practices that helped us benchmark against other companies in our industry. We don’t have a Director of Analytics here, so their expertise was invaluable in helping us understand our data better.”

The power of data at everyone’s fingertips

“With Mixpanel, everyone now has the data at their fingertips, and I cannot overstate just how powerful that is. In fact, I invited our entire company to attend the Mixpanel training. I encourage everyone to take advantage of the platform—no matter which department you’re in, it can help you do your job better.”

Pinpointing drop-offs with Funnels

“We use Funnels heavily here at Brightside. When I was educating our team about Mixpanel, they understood the power of Funnels immediately. When I work with our PMs, I ask them, “What questions do you want to answer when this feature goes live?” This helps us figure out the sequence of events we need to track, which easily maps to a Funnel. Funnels then allows us to find the biggest points of drop-off and focus our efforts there.”

General Advice

Figure out the problem first

“One of the pitfalls is that people are eager to track all of their events, but once that’s done, they don’t know where to get started. On top of that, they’ve lost sight of the problem they were trying to solve in the first place.

As cliché as it sounds, my best advice for solving a problem is to fall in love with it. Don’t get caught up in immediately looking for solutions. You need to fully understand the problem first. After that, you need to be able to measure success. But you can’t measure everything. So figure out the questions you need to answer to know if you’ve solved the problem. After that, it’s much easier to turn to your data for the answers.”