Personal finance management company, Quicken, switched to Mixpanel to better track the behaviors of its customers and improve their overall experience.

Company

Used by over three million customers, Quicken is a personal financial management application. The company helps customers to live healthy financial lives by allowing them to track their spending, pay their bills, and monitor investments all in one place.

Goals

In order to improve the customer experience, the Quicken product team needed to understand what was working and not working for customers. Previously, the company was using Adobe Analytics (Omniture), but product managers found it difficult to analyze their data, build dashboards, and see real-time reports. They needed a solution that could do more.

Solution

Moving to a new analytics platform

Unlike Adobe Analytics (Omniture), Mixpanel had intuitive reporting and custom dashboards that allowed teams to quickly find actionable insights. The product managers were so happy with Mixpanel that they moved off the Omniture platform altogether. Mixpanel quickly fulfilled all of Quicken’s analytics needs across its product, marketing, engineering, and analytics teams.

Transitioning to a new SaaS model

The team had pivoted from selling traditional licensed software to a subscription-based SaaS model. They made this change to free customers from an annual upgrade process and allow the product teams to shift from supporting multiple, different “versions” to delivering continuous improvement to a single code base. To help customers transition to this superior model, Jeff Parker, VP of Product Strategy & Design at Quicken says, “Mixpanel is instrumental because, in order to understand what our customers need, we need to know what is going on in the product. This allows us to prioritize our roadmap around our customers’ needs and allocate resources wisely to move KPIs based on data rather than gut instinct.”

Providing users with a seamless experience

Mixpanel insights help Jeff and his team retain users by providing them with a seamless experience. Connecting to 14,000 financial institutions, it’s important to be able to track when customers are successfully aggregating their financial data into Quicken. Monitoring aggregation success rates allows Jeff’s team to know what’s working, and what’s not, in the setup process. This also lets them identify the issues impacting the most customers so they can allocate resources strategically while directly measuring the results of any changes in the user experience.

Arming cross-functional teams with data

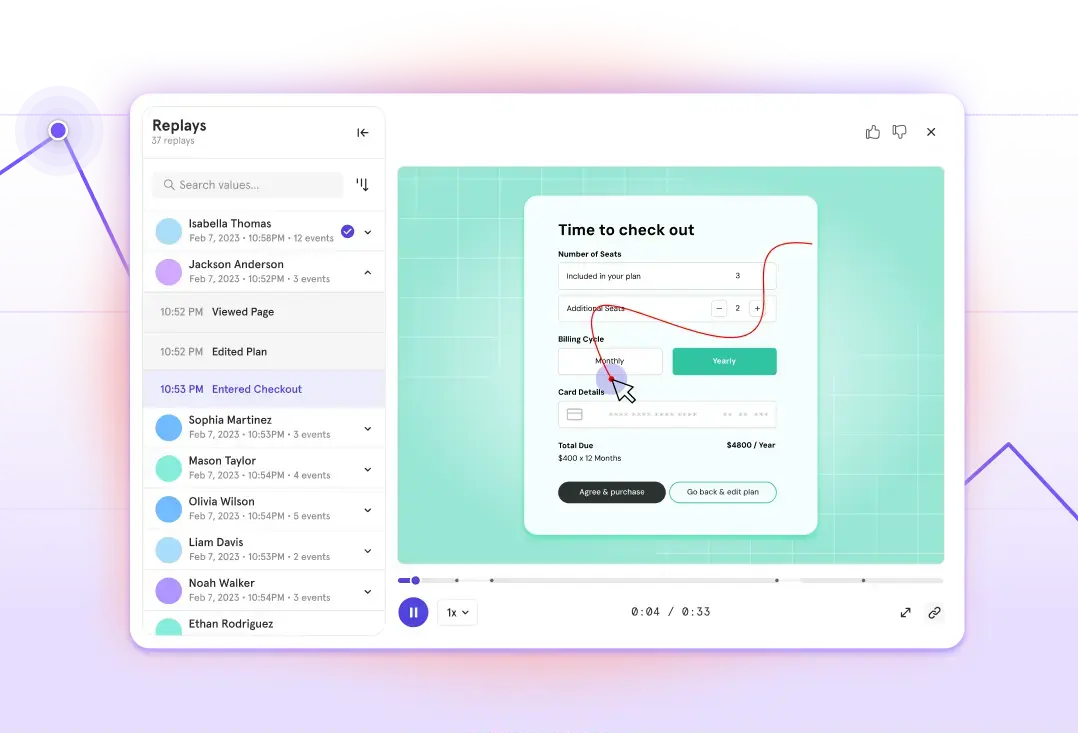

Mixpanel data is used across functional areas, from weekly finance and business reviews to behavior tracking, product testing, and API monitoring. Engineering uses Mixpanel to help surface and fix errors in the product. Marketing relies on Mixpanel funnel analysis to identify drop-off points in the purchase process. As Jeff said “Mixpanel is an accessible tool that helps answer ad hoc questions across the company. It’s hugely valuable.”

The data we get from Mixpanel is vital to what we do, day in and day out. Teams across the company are able to answer their own analytics questions easily, without any developer skills.Jeff Parker VP of Product Strategy & Design, Quicken

Results

Quicken continues to use Mixpanel to see the influence changes have on its customers’ financial wellbeing. The team is developing a metric to quantify “financial health,” going beyond measuring engagement to measuring impact. This will allow the company to help even more customers lead healthy financial lives.