The product analytics platform behind finance's success stories

Capital One’s challenge isn’t lack of data, it’s making sense of it.

Between KYC drop-offs, underutilized features, and churn you didn’t see coming, product data can feel overwhelming. Mixpanel connects the dots for you.<br />

You’re collecting all the right signals—now it’s time to act on them. Mixpanel gives your teams the clarity to move faster and smarter.

Capital One's customers expect personalized, seamless digital experiences. You need the behavioral data and insight to deliver them, consistently.<br />

How Mixpanel Solves It

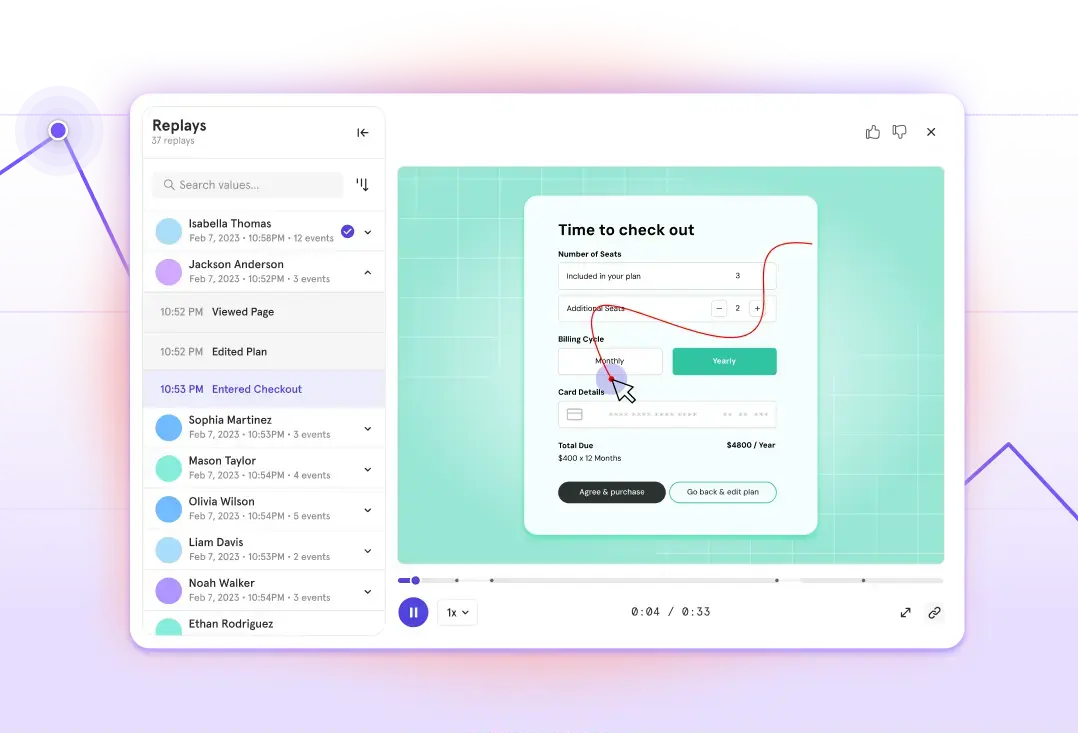

Visualize every user journey

Identify where users drop off in onboarding or don’t adopt key features.

Pinpoint friction, fast

Know exactly what’s slowing down KYC completions or suppressing feature usage.

Act with confidence

Send targeted messages or campaigns to re-engage and drive adoption.

Predict churn before it happens

Spot risky behavioral patterns and retain high-value users with proactive strategies.

Strengthen fraud detection

Analyze behavioral anomalies for faster, more accurate fraud response.

0