More analytics, less money: Introducing simpler, better pricing from Mixpanel

At Mixpanel, we recently celebrated 15 years of helping our customers learn from their data. Along the way, we’ve been proud to enable the world's largest companies to move faster, to get everyone aligned, and to self-serve insights that drive critical business decisions. But building products and websites has challenges at all business sizes, so we’ve always firmly believed that access to data to make the right decisions is just as important pre-seed as it is post-IPO.

The first rule of product is: Listen to your users. And what we’ve heard from our small- to medium-sized customers is that now more than ever, we need to make it quick and easy to start with Mixpanel, without breaking the bank. That’s why today we’re announcing some changes to our plan offerings that will make Mixpanel your best possible analytics partner all the way through from day one to market domination.

Mixpanel’s Growth plan now includes more monthly events and analytics features than ever—and starting at $0:

- 1M monthly events for free

- 20k monthly replays with Session Replays for free

- Autocapture to get set up with insights sooner

Making innovation more affordable

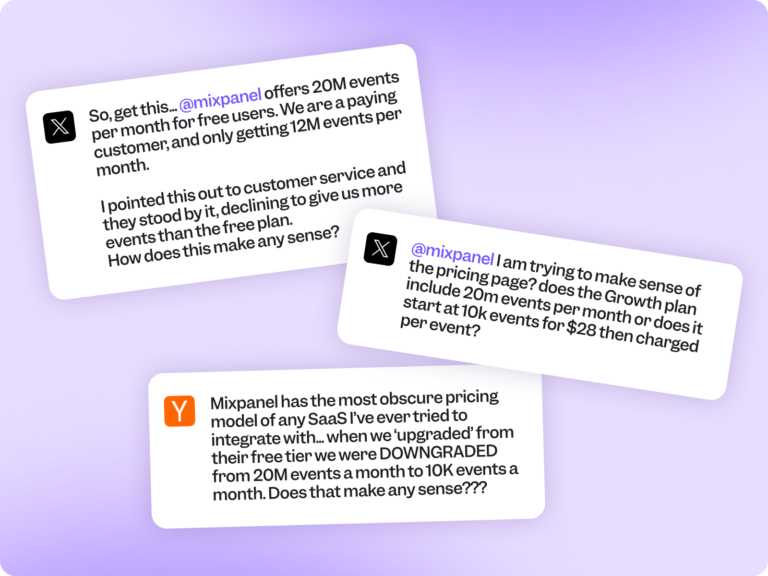

We’ve long offered the best Free analytics plan on the market—which includes 1M events a month. But, admittedly, the structure of our Growth plan, which started at $24 a month and traded event capacity for more analytics features, was confusing and not the best value we could offer for our customers. We know that because you told us.

We’ve taken to heart every piece of feedback about this, and it’s why we are now making our Growth plan 100x better. Our Growth plan now starts with 1M events per month included for free.

This means any usage under 1M monthly events on our Growth plan costs $0 and includes same advanced analytics features our Growth plan has always offered, like:

- Multi-touch attribution

- Formulas & saved metrics

- Behavioral cohorts

- Impact & statistical significance

(Getting started on our Growth plan requires adding a credit card to your account. More details on how our plan pricing works can be found here.)

We’ve also learned how much value customers are getting from Mixpanel’s Session Replay. Small customers in particular love Session Replay because when you have only a few users, quantitative data is less relevant. Actually getting to see users in action and understand how they are interacting becomes exponentially more important. That’s why we’ve added 20,000 monthly replays to our Growth plan for free, giving you the opportunity to learn more about your users.

And we recently revamped our Mixpanel for Startups plan, where qualifying startups now get their first year of Mixpanel (including everything in the Growth plan plus some Enterprise features) for free.

Our generous Free plan remains unchanged, offering the same 1M monthly events in addition to essential analytics features and 10k monthly replays with Session Replay—with no credit card needed to sign up.

A new, faster way to get started

Another big takeaway when listening closely to our product feedback: You have too much to do and not enough time to do it—so now, more than ever, it’s important to get started with analytics quickly. Every minute counts, and without understanding your data and users, you might miss important early insights that can carry your product or business to the next level.

We’re excited to roll out Autocapture so that you can start with analytics in under two minutes. Autocapture enables you to automatically capture commonly tracked user interactions—like page views and element clicks—using a single code snippet.

“Just connected Mixpanel Autocapture to my startup website and I have to say time to value is awesome. Speed is everything now and being able to get the key, clicks, page views, etc. right away is really powerful.”

There are no compromises with using Autocapture to get started. You still get set up for all the same advanced analysis of Mixpanel—just faster. And it’s always possible to add precision event tracking down the road if you decide. Many customers will ultimately use both autocapture and precision tracking in tandem; we’ve designed our Autocapture with that in mind.

Autocapture is available for all of our customers, including, of course, those on our Free and Growth plans. Learn more about it here.

Here for every step of your journey

As the pioneer of digital analytics, we have over a decade and a half of experience helping companies grow from founding to Fortune 500. Our time as a market leader gives us a unique vantage point into how analytics–and the needs of companies–evolve.

When companies start out, they’re often tempted by analytics options with many lightweight features packed into one platform. We’ve seen time and time again that these solutions end up being unscalable as companies grow—and result in the need to switch to a solution like Mixpanel that offers more in-depth analysis. This is a painful realization because switching platforms is time- and resource-intensive.

With our updated pricing and Autocapture feature, Mixpanel is the best option to start your journey for free and avoid the pains of switching as you grow and scale. It’s affordable, easy to start with, and includes the depth from the get-go that you’ll need as you grow. We’re here for every step of your digital analytics journey.

That goes beyond pricing and Autocapture, too, since we also have a dedicated support team ready to help no matter which plan you’re on. And don’t forget the 11,000+ members in the Mixpanel Community.

Begin your path to growth

Here’s to more years ahead of helping you learn from your data 🤝