What is customer acquisition cost?

What is Customer Acquisition Cost

Consumer acquisition cost (CAC) is one of the most important metrics a business needs to calculate. It’s a figure used for establishing growth projections, as well as a company’s value. Like everything else in business, there is no singular way to talk about CAC. Andrew Chen described it perfectly when he wrote, “[It’s] a nuanced calculation with lots of gotchas.”

Calculating Customer Acquisition Cost

The easiest place to start when talking about CAC is how to calculate it.

First you add all of the costs that go toward customer acquisition during a specific period, like sales and marketing expenses for September. And then divide the sum of your expenses during that period by the number of customers acquired in that time.

The calculation looks like this:

(Total customer acquisition costs per n-period) / (Number of customers acquired per n-period)

2017 Consumer Acquisition Cost

Pay per click: $100

Sales & Marketing: $19,900

Inbound marketing: $25,000

Total Spend for 2017: $45,000

Total Customers Acquired in 2017: 1,000

Customer Acquisition Cost: $45

What costs should you calculate in the CAC formula?

This is where things start getting complicated — where the “gotchas” begin.

The costs you should calculate in your CAC formula is important because plugging in the wrong expenses, or too few expenses, will result in a number that does not truly reflect the business’s success — or lack of success. Calculating the wrong CAC could interfere with efforts to secure funding, set goals, or determine where to make budget cuts.

To get an accurate CAC, the figures in the numerator should include every dollar the company spends on acquiring customers. Here are some expenses you might not think should be calculated in your CAC formula — but certainly should be:

Overhead – Include rent and utilities, but limited to an amount that can be attributed to employees whose work involves customer acquisition. If sales and marketing departments account for a fifth of your company, then calculate ⅕ of your overhead costs. And you can tack on even more caveats, like calculating costs for contractors and freelance employees who work on customer acquisition part-time and other aspects of the business the remainder of the period.

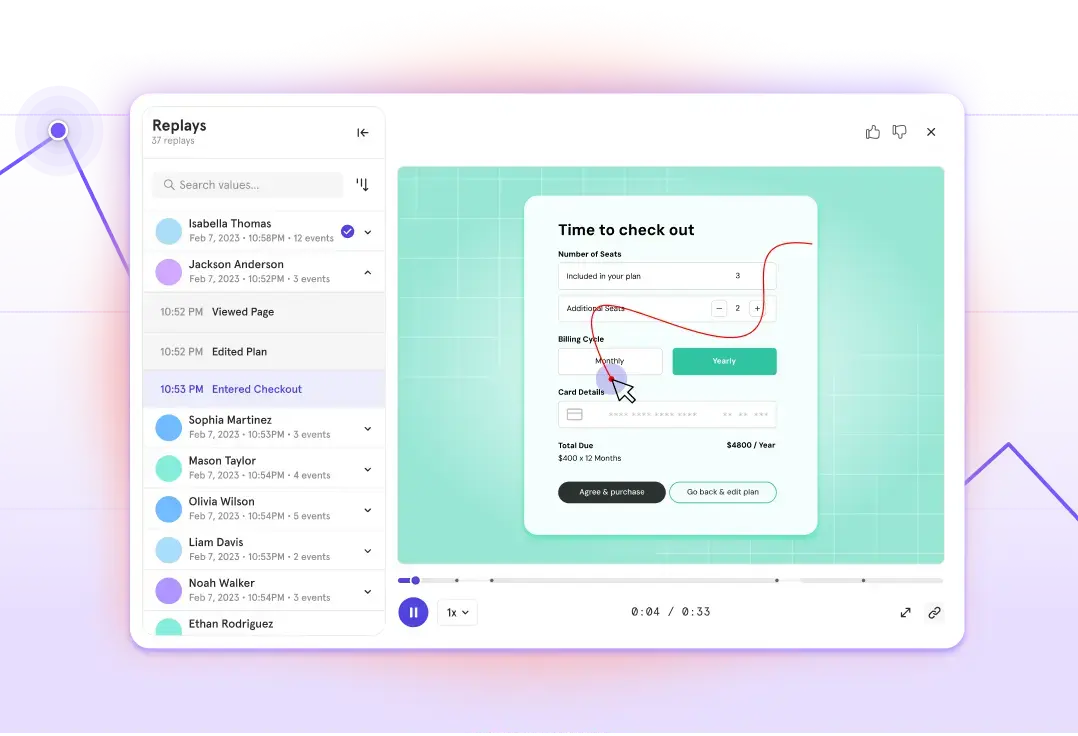

Equipment and tools – Include items like the amount paid for office furniture in the marketing and sales departments. Also, the SaaS platforms your company purchased or subscribed to, like Constant Contact for managing email campaigns and Mixpanel for powerful analytics tools.

Salaries – For some employees, like Google Ads, SEO, and content professionals, it’s likely at or near 100 percent of their salaries; but for others, like a web designer, it might be 50 percent, or even lower. Even a fraction of the salary paid to workers responsible for company finances and overall business strategy should be included in calculations if a portion of their time goes toward supporting customer acquisition efforts.

Brian Balfour, past VP of growth at Hubspot, suggests carefully scrutinizing any expenses you overlook when formulating the cost of acquiring customers. “[One] mistake is only including marketing and sales expenses in the numerator for new customers, but including all customers (including returning customers) in the denominator. This will make your CAC look artificially low.”

What is a Customer?

You might think everyone would at least agree on the definition of a customer. But even on that point, companies encounter certain ambiguities — or “gotchas.”

For an e-commerce website like Etsy, it’s pretty clear that anyone who purchases a product is a customer. But what about a SaaS platform with paid and freemium products? Slack is an example of such a business model. The team-messaging platform hosts millions of free users and also thousands of paying customers. Technically, a non-paying freemium user is considered a customer (and it costs money to acquire and maintain these users), but you don’t treat free users the same as you treat paying customers. That’s because it costs more to maintain paying customers. For example, it typically requires some type of human touch to help new paying customers get started or provide support throughout their membership. But it would not be cost-effective to provide the same human support to users on your freemium tier.

So it’s important to compare apples to apples. Paying customers are apples, freemium users are…not. And then there are those in between — the freemium users moving through the funnel on their way to becoming actual paying customers.

All Customers are not Created Equally

Acme is a SaaS startup with a few employees and at this early stage, they mostly focus on acquiring new subscribers. So the team signs up for a free account with a fictional email marketing platform (EMP). Beta is a larger, more established SaaS company. They’re on a paid tier with EMP because they rely on email campaigns to attract new customers, reduce churn, and try to win back those who left. So EMP should calculate these two types of customers separately: paying and non-paying.

And then there’s a third group: SaaS company Cato has just started turning a profit and they went from small startup to mid-size company. Now they’re moving through EMP’s sales funnel, on their way from freemium to a paid tier.

What EMP pays per transitioning customer is almost definitely different — and higher — than what the company pays to acquire new paying customers and new freemium customers.

There’s a debate that anyone who is not a paying customer should not be calculated in the CAC. Rather, leads, trial users, freemium tiers, and those transitioning can be calculated in a cost per acquisition, or CPA. According to Balfour, the two are often conflated and shouldn’t be. But they are related because “CPA is usually used to measure the cost of things that are leading indicators to CAC.”

Consider a project management system for teams that offers a freemium product and a pro paid tier, like Trello. Estimate CAC for new customers that sign up and pay to use the product and then use CPA for registrations by non-paying users.

LTV:CAC Ratio

All that said, it’s also important to see CACs using a formula that combines all users together for the purpose of estimating what it will take to recover from the investment in customer acquisition and turn a profit.

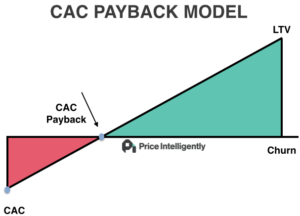

Imagine a seesaw, with one side weighed down by the outgoing cost of acquiring customers and the other side light on incoming payments from customers. In the beginning you spend more than you bring in. As time goes on, the amount of money coming in will start to offset the amount going out. You eventually break even, and then, over an individual’s lifetime as a paying customer, the company will recover their initial investment. Profitwell.com calls it the CAC Payback Model.

The red portion of the graph represents the cost a company pays to acquire a new customer. As the customer continues paying for the service, the company breaks even and eventually earns back their ROI. From there, profits keep going up and up until (or if) the customer leaves.

Customer Lifetime Value

A customer’s lifetime value (CLTV) refers to the profit a company estimates earning over the course of the customer’s lifetime with the company. The LTV:CAC ratio is the difference between the lifetime value of a customer and the cost of acquiring that customer.

For a successful business, the cost of acquiring customers will be significantly lower than the customer’s lifetime value. For startups that haven’t been around long enough to earn their ROI, you’re going to see a high CAC and low CLTV.

Reducing CAC

Another reason companies want to know their CAC is so that they can reduce it. As long as the cost of acquiring a customer is still higher than CLTV, the business can’t be profitable. When you know your CAC, you can look at your sales cycle and strategize ways to get customers using your product faster and analyze marketing channels for the purpose of optimizing those that produce more leads.