The top 21 metrics for startups to track

Too many startups make the mistake of launching without a clear understanding of their KPIs. Or worse, they track vanity metrics that don't provide actionable insights.

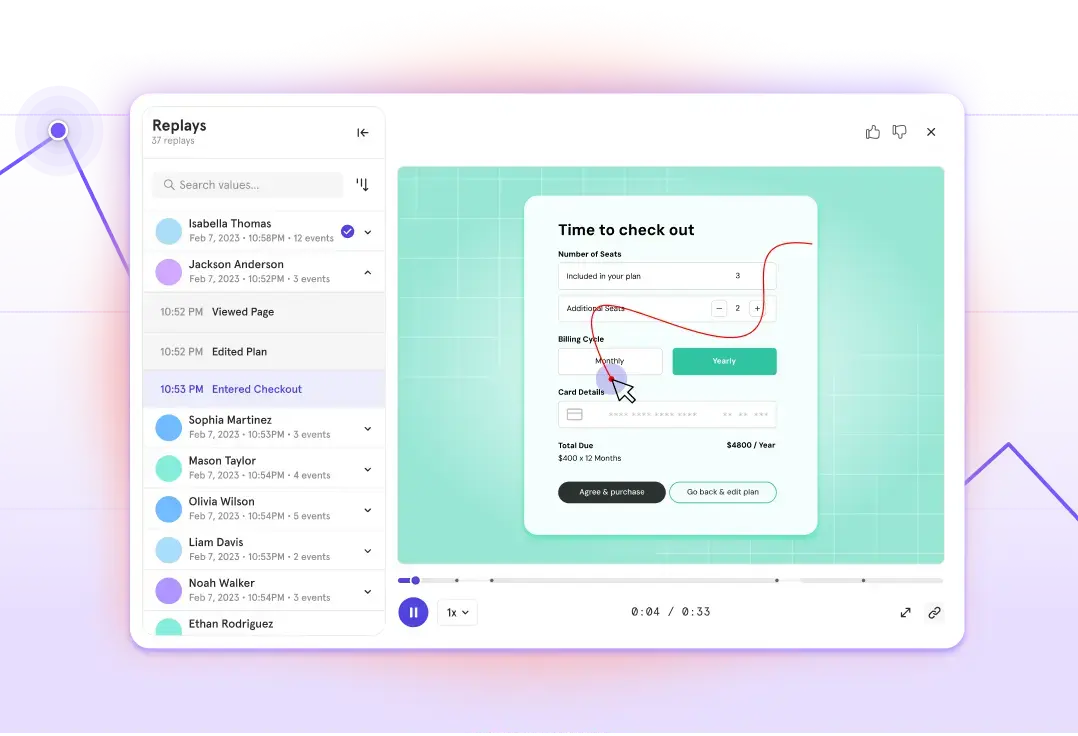

To succeed, startups need to track the right metrics from day one. This means having clear definitions for each metric, agreed upon by all teams, and knowing how to interpret the data. In this article, we'll break down the top 21 essential metrics every startup needs to track and how to turn data into action. (Tip: you can track all the metrics below using Mixpanel when you join our new, updated startups program.)

Business and financial metrics for startups to track

Bookings vs. revenue

This is a crucial metric for several reasons as it provides startups with valuable insights into their sales performance, financial health, and future growth prospects. In particular:

- Forecasting future revenue: Bookings provide a forward-looking view of a startup's financial health. They represent the value of contracts signed with customers, even if the revenue hasn't been recognized yet. This helps startups predict future income streams and make informed business decisions.

- Evaluating sales performance: By comparing bookings to actual revenue, startups can assess the effectiveness of their sales strategies. Strong bookings growth indicates a healthy sales pipeline and growing customer base.

- Managing cash flow: Startups often have limited resources, and knowing when to expect revenue from bookings helps them plan expenses and investments.

- Investor relations: Bookings are a key metric that investors look at when evaluating a startup's potential. Strong bookings growth can attract investment and boost confidence in the company's future.

What to do with the data

- Analyze bookings growth: Are you securing more contracts and increasing the value of your deals? This can indicate strong sales performance and future revenue potential.

- Monitor revenue recognition: Ensure you’re recognizing revenue accurately and in compliance with accounting standards. This provides a clear picture of your current financial performance.

- Compare bookings to revenue: A large gap between bookings and revenue might indicate a long sales cycle or delays in service delivery. This can impact cash flow and financial forecasting.

- Use bookings for forecasting: While not actual income yet, bookings can help project future revenue and plan for growth.

Keep in mind there are timing differences to be aware of since bookings are recorded when the contract is signed, while revenue is recognized over time as services are delivered. Also, for subscription businesses, the portion of bookings that hasn't yet been earned is recorded as deferred revenue on the balance sheet.

Recurring revenue vs. total revenue

This comparison helps startups understand the predictability and stability of their income. Specifically, recurring revenue is the portion of revenue that comes in regularly, like subscription fees. It provides a stable foundation and is a key indicator of long-term success. Ideally, this number would increase over time and a high recurring revenue means greater predictability for future income, which is crucial for planning and investment.

Total revenue encompasses all revenue streams, including one-time sales, project fees, etc. While important, it doesn't provide the same level of stability as recurring revenue.

What to do with the data

- Low recurring revenue: Focus on strategies to increase recurring revenue streams, such as offering subscriptions, loyalty programs, or long-term contracts.

- High recurring revenue: Prioritize customer retention and expansion to maximize the value of your existing customer base.

Gross profit

Gross profit reveals the profitability of a core product or service after deducting the direct costs associated with producing it. This metric is essential for:

- Pricing analysis: Are your prices high enough to cover your costs and generate profit?

- Cost management: Are there opportunities to reduce the cost of goods sold (COGS) without sacrificing quality?

- Product/service viability: Is your core offering profitable enough to sustain the business?

What to do with the data

- Low gross profit: Analyze your pricing, COGS, and production processes to identify areas for improvement.

- Healthy gross profit: Invest in growth initiatives, like marketing and sales, to further increase revenue and profitability.

Total contract value (TCV) vs. annual contract value (ACV)

These metrics provide insights into the long-term value of your customer relationships, especially for businesses with longer-term contracts. Total contract value (TCV) is the total value of a customer contract over its entire duration, including all recurring and one-time fees. It provides a comprehensive view of the revenue potential from a specific customer. Annual contract value (ACV) is the average annual revenue generated from a customer contract. It helps normalize revenue across contracts with different durations and provides a more consistent basis for comparison.

What to do with the data

- Analyze trends in TCV and ACV: Are you securing larger contracts or increasing the average annual value of your deals?

- Forecast future revenue: Use ACV to project recurring revenue and plan for future growth.

- Identify upselling and cross-selling opportunities: Analyze contracts with lower ACV to identify potential for increasing customer value.

Lifetime value (LTV)

LTV predicts the total revenue you can expect from a single customer throughout their entire relationship with your company. This is a crucial metric for a few reasons:

- Customer acquisition cost (CAC) analysis: Is your CAC lower than your LTV? If not, you're losing money on each new customer.

- Segmentation and targeting: Identify your most valuable customer segments and tailor your marketing efforts to them.

- Retention strategies: Understand how much to invest in keeping your customers happy and engaged.

What to do with the data

- Low LTV: Focus on increasing customer lifespan (retention), purchase frequency (upselling/cross-selling), or average purchase value.

- High LTV: Invest in acquiring more customers within that high-value segment and prioritize their satisfaction.

Gross merchandise value (GMV) vs. revenue

This comparison is particularly relevant for marketplaces or platforms that facilitate transactions between buyers and sellers. Gross merchandise value (GMV) is the total value of merchandise sold through your platform. It indicates the overall size and growth of your marketplace. Revenue comes into play because it’s your actual earnings from those transactions, which is typically a percentage of the GMV (e.g., commissions, transaction fees).

What to do with the data

- Analyze GMV growth: Is your marketplace attracting more buyers and sellers?

- Monitor revenue generation: Are your fees optimized to maximize profitability while remaining competitive?

- Identify areas for improvement: Can you increase GMV by attracting more high-value sellers or improving the buyer experience?

Unearned or deferred revenue (and billings)

This metric is especially crucial for subscription businesses as it reflects the money you've received for goods or services that haven't yet been delivered. It provides insights into:

- Future revenue: Unearned revenue represents a backlog of obligations that will be recognized as revenue over time.

- Financial health: A growing unearned revenue balance can indicate strong sales and customer confidence in your future services.

- Cash flow management: While billings represent the invoices sent to customers, unearned revenue reflects the actual cash collected.

What to do with the data

- Monitor unearned revenue trends: Is it increasing or decreasing? This can indicate the health of your subscription business.

- Forecast future revenue: Use unearned revenue to project revenue recognition in upcoming periods.

- Manage cash flow: Understand the timing of cash collection relative to service delivery to ensure adequate working capital.

Customer acquisition cost (CAC)

CAC tells you how much it costs to acquire a new customer. This is important for:

- Evaluating marketing efficiency: Are your marketing campaigns cost-effective?

- Setting budgets: How much should you allocate to acquire new customers?

- Pricing strategies: Does your pricing allow you to recoup CAC and generate profit?

What to do with the data

- High CAC: Analyze your marketing and sales processes to identify inefficiencies. Experiment with different channels or strategies to reduce acquisition costs.

- Low CAC: Consider increasing your marketing budget to acquire more customers, as long as your LTV is higher than your CAC.

Gross margin

Gross margin is calculated by: (Revenue - cost of goods sold) / revenue. You might think that the cost of goods sold is mostly related to manufacturing companies but that’s not true. For example, SaaS companies—their cost of goods sold includes items like Amazon Web services or bandwidth. Gross margin is a key indicator of:

- Pricing strategy: Are you pricing your products or services effectively?

- Cost control: Are you managing your direct costs efficiently?

- Profitability: How much profit are you generating from your core operations?

Burn rate

Burn rate is the speed at which your startup is spending its cash reserves (the amount your bank balance decreases each month). It’s calculated by: Monthly costs - revenue and is a vital indicator of:

- Financial sustainability: Can your current spending be sustained with your existing resources?

- Operational efficiency: Are you spending wisely, or are there areas where you can cut costs?

- Funding needs: When will you need to raise more capital?

What to do with the data

- High burn rate: Scrutinize your expenses and identify areas where you can save. Negotiate better deals with vendors, optimize marketing spend, and consider delaying non-essential expenditures.

- Unexpected changes in burn rate: Investigate the causes. Is it due to increased investment in growth, unexpected costs, or declining revenue?

- Consistently monitor burn rate: This helps you anticipate funding needs and make informed decisions about spending and growth initiatives.

Runway

Similar to burn rate, runway tells you how many months your startup can operate with its current cash reserves at its current burn rate (i.e., how many months until you run out of money). It's essential for:

- Financial planning: When will you need to secure additional funding?

- Strategic decision-making: Can you afford to invest in growth initiatives, or do you need to focus on extending your runway?

- Investor communication: Demonstrate to investors that you have a clear understanding of your financial position and a plan for the future.

What to do with the data

- Short runway: Take immediate action to reduce burn rate or secure additional funding. Explore options like bridge loans, venture capital, or crowdfunding.

- Long runway: This provides more flexibility to invest in growth, hire talent, and pursue strategic initiatives.

- Regularly reassess runway: As your burn rate and cash balance change, update your runway calculation to ensure you have an accurate picture of your financial position.

Product engagement metrics for startups to track

Active users

- Product adoption: How many people are consistently using your product?

- User engagement: Are users finding value in your product and returning for more?

- Growth trends: Is your user base growing or shrinking?

This metric measures the number of users actively engaging with your product or service within a specific timeframe (daily, weekly, monthly). These are often referred to as DAU, WAU, and MAU and all are signals of:

What to do with the data

- Low active users: Investigate why users aren't engaging. Are there usability issues, lack of compelling features, or poor onboarding?

- Declining active users: Identify the reasons for churn and implement strategies to improve user retention.

- Analyze active user segments: Understand the behavior of your most engaged users and tailor your product and marketing efforts to attract and retain similar users.

“Obviously, economic data is important, but the younger the startup, the more important product data is in the fundraising process. … It shows the startup has the ability to make the right decisions.”

Monthly active users (MAU)

MAU is a crucial metric for understanding the overall health and growth of your user base. It represents the number of unique users who engage with your product or service within a 30-day period. By tracking MAU, you’ll have a better idea of:

- Product adoption: How many people are actively using your product?

- User engagement: Are users finding value and returning regularly?

- Growth trends: Is your user base growing or shrinking over time?

What to do with the data

- Low MAU: Investigate why users aren't engaging. Are there usability issues, a lack of compelling features, or poor onboarding?

- Declining MAU: Identify the reasons for churn and implement strategies to improve user retention.

- Analyze MAU segments: Understand the behavior of your most engaged users and tailor your product and marketing efforts to attract and retain similar users.

Month-over-month (MoM) growth

MoM growth measures the percentage change in a specific metric (e.g., active users, revenue, downloads) from one month to the next. It helps you:

- Track progress: Are you growing at a healthy rate?

- Identify trends: Are there seasonal patterns or other factors influencing your growth?

- Set goals: What growth rate are you aiming for?

What to do with the data

- Positive MoM growth: Identify the factors contributing to growth and double down on those strategies.

- Negative MoM growth: Investigate the causes of the decline and take corrective action.

- Analyze trends over time: Is your growth accelerating, decelerating, or remaining stable?

"The most important thing is seeing user activity grow within a product organically."

Churn

Churn rate measures the percentage of users or customers who stop using your product or service within a specific timeframe. It's a critical measure of:

- Customer retention: How well are you retaining your users?

- Revenue stability: High churn can lead to unpredictable revenue streams.

- Product-market fit: High churn may indicate that your product isn't meeting customer needs.

What to do with the data

- High churn rate: Identify the reasons why users are leaving. Conduct surveys, analyze user behavior, and improve your product or customer support.

- Analyze churn by segment: Are certain types of users more likely to churn?

- Implement retention strategies: Offer incentives, personalized experiences, and proactive customer support to reduce churn.

Downloads

This metric is specific to apps and other digital products that highlights:

- Marketing effectiveness: Are your marketing campaigns driving downloads?

- User acquisition: How many people are interested in trying your product?

- Market reach: Is your product gaining traction in your target market?

What to do with the data

- Low downloads: Review your app store optimization (ASO), marketing campaigns, and product positioning.

- Analyze download trends: Are downloads increasing or decreasing?

- Track downloads by version: Are new features or updates driving more downloads?

Activation rate

Activation rate measures the percentage of users who complete a desired action or onboarding process after signing up for your product or service. It demonstrates they're getting value from your product (e.g., creating an account, completing a tutorial, making a purchase) and it’s key for these reasons:

- Onboarding effectiveness: Is your onboarding process guiding users to success?

- Product stickiness: Are users experiencing the core value of your product early on?

- Long-term engagement: Activated users are more likely to become loyal customers and product advocates.

What to do with the data

- Low activation rate: Optimize your onboarding process, improve user experience, and highlight the key benefits of your product.

- A/B test different onboarding flows: Experiment with different approaches to see what drives the highest activation rates.

North Star

Your North Star Metric is the single most important metric that reflects the core value your product delivers to customers. It acts as a guiding star for your entire company, aligning all teams toward a common goal so that you can:

- Focus: Ensure everyone in the company is working towards the same objective.

- Prioritize: Make data-driven decisions about product development, marketing, and other initiatives.

- Measure success: Track progress towards your ultimate goal.

How to identify your North Star:

- Consider your product's core value proposition. What is the key benefit you offer to customers?

- Choose a metric that directly reflects that value and is measurable and actionable.

- Ensure the metric is aligned with your business goals and can be influenced by your team's efforts.

What to do with the data

- Communicate it clearly to your team: Ensure everyone understands the importance of the metric and how their work contributes to it.

- Track your North Star metric closely: Monitor progress over time and identify any factors that are impacting it.

- Use it to guide decision-making: Prioritize initiatives that will drive improvement in your North Star metric.

Retention rate

Retention rate measures the percentage of users or customers who continue using your product or service over a given period—usually monthly, quarterly, or annually. By measuring retention rate, startups will have a better idea into:

- Customer loyalty: How many users are sticking with your product?

- Long-term value: Retained customers generate more revenue and are less expensive to serve than new customers.

- Product-market fit: High retention suggests that your product is meeting customer needs.

What to do with the data

- Low retention rate: Identify the reasons why users are churning and implement strategies to improve user experience, customer support, and product value.

- Analyze retention by cohort: Are certain groups of users more likely to churn? If so, why?

- Implement retention strategies: Offer incentives, personalized experiences, and proactive customer support to keep users engaged.

Other startup metrics to consider

Net Promoter score (NPS)

NPS measures customer loyalty and satisfaction by asking users how likely they are to recommend your product or service to others. A high NPS is a good sign that your startup is performing well and could disrupt an industry. NPS is valuable to track because:

- Understanding customer sentiment: How happy are your customers with your product and overall experience?

- Identifying promoters and detractors: Who are your most loyal customers and who is most likely to churn?

- Improving customer experience: Use feedback from NPS surveys to identify areas for improvement.

What to do with the data

- Low NPS: Address the concerns of detractors and focus on improving customer experience.

- Analyze feedback from promoters: Understand what they love about your product and use that information to attract new customers.

- Track NPS over time: Monitor changes in your score to gauge the impact of your efforts to improve customer satisfaction.

Cost per acquisition (CPA)

CPA measures the average cost of acquiring a new customer through a specific marketing channel or campaign. It's crucial for:

- Evaluating marketing efficiency: Are your marketing campaigns cost-effective?

- Optimizing ad spend: Which channels are delivering the best ROI?

- Setting budgets: How much should you allocate to acquire new customers?

What to do with the data

- High CPA: Analyze your marketing campaigns to identify areas for improvement. Experiment with different targeting, messaging, and creative.

- Compare CPA across channels: Identify the most cost-effective channels for acquiring new customers.

- Track CPA over time: Monitor changes in your CPA to assess the impact of your optimization efforts.

Join the Mixpanel for Startups program today

Take your startup to the next level by transforming your data into actionable insights with the Mixpanel for Startups program. Join today and let's build something amazing together!