From telecom to fintech giant: Insights from JazzCash’s digital growth journey

When I transitioned from consulting to join Jazz over a decade ago, I believed I was stepping into a world of transformative technology. Jazz, Pakistan’s leading digital operator and the country’s first GSM provider, had already revolutionized mobile connectivity. After all, I joined during the 4G revolution, an exciting time for telecom.

Yet, what struck me early on, particularly during my first visit to Mobile World Congress, was a prevailing sense of urgency within the global telecom community—either evolve into digital platforms or risk becoming irrelevant.

This realization shaped Jazz’s strategic direction going forward. We recognized that staying relevant meant moving beyond connectivity into platform-based solutions. Our decisions weren’t made on instinct, they were data-driven. One particularly compelling insight showed that, on average, customers spent just 25 minutes a day on voice calls, but nearly six hours on mobile data. That clear behavioral signal underscored the need to invest in digital platforms.

We started to push ahead with our transformation, beginning with our enterprise and later cloud business while venturing into entertainment with our Tamasha platform, among others. However, the biggest success story has been JazzCash, our fintech platform.

Building JazzCash: Pakistan’s leading fintech provider

Today, JazzCash stands as Pakistan’s leading mobile wallet and digital financial services platform, serving over 50 million users. While it’s the country’s largest consumer platform, the greater opportunity lies in digitizing Pakistan’s micro, small, and medium enterprises (MSMEs), which contribute 38% to national GDP but remain overwhelmingly cash-reliant. We’ve onboarded over 500,000 merchants to bring these enterprises into the digital financial ecosystem.

JazzCash began as a basic over-the-counter service, allowing customers to cash in and out at agent locations. Over time, we expanded into stored-value accounts, QR-based payments, payment gateway services, micro-insurance, lending, and a broad suite of financial use cases. But the transformation wasn’t just about launching new features, it was about rethinking the fundamentals of how we built, scaled, and monetized our business.

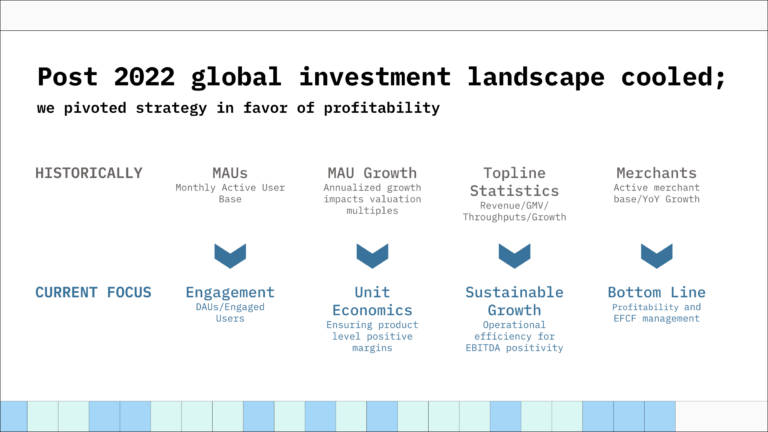

Abandoning vanity metrics and refocusing on what matters more

Between 2020 and 2022, fintech globally experienced a boom. New entrants penetrated the market and growth metrics such as Monthly Active Users (MAUs) became the industry’s primary metric. We too were chasing aggressive targets, backed by significant marketing budgets.

But when the global funding environment tightened in 2022, it forced a necessary reckoning. We realized that hypergrowth without profitability was unsustainable. Knowing that, our focus shifted to more meaningful engagement metrics—Daily Active Users (DAUs), Engaged Users, and unit economics. This recalibration helped us realign priorities, optimize spends, and build healthier customer journeys that could sustain themselves financially.

Taking a harder stance on product economics was crucial, too. Many offerings, though popular, lacked positive unit economics. We made the decision to discontinue or redesign any feature that wasn’t either breakeven or accretive to the bottom line. This marked a broader shift in our philosophy; from chasing top-line growth to building a resilient, profitable engine. With greater discipline around EBITDA and Earnings Held for Customer Funds (EHCF), we managed to steer the business from a loss-making trajectory to sustainable profitability.

Three levers of transformation: Product, platform, and people

Three core elements powered this transformation: product, platform, and people. On the product side, regulatory changes introduced during the pandemic forced us to rethink our revenue streams. Key pricing levers such as peer-to-peer transaction or cash-in fee were no longer permissible. We responded by accelerating our portfolio of lending and monetizable value-added services, enabling us to preserve financial momentum while staying compliant.

The platform was equally critical. Fintech is an infrastructure-heavy business where reliability is non-negotiable. Recognizing that earlier outages were unacceptable for a financial institution, we invested significantly in platform stability, ultimately achieving 99.999% uptime. This reliability became a key enabler for user trust and transactional consistency.

Then there were the people. Transformation of this scale demands stability and alignment. During a particularly volatile period from 2019 to 2022, we had multiple changes to the management. The lack of continuity created structural and strategic friction. We knew it was important to have consistency at the leadership level and across teams. By investing in leadership development, retaining key talent, and building a strong product and technology organization, we created the cultural foundation necessary for long-term execution.

Optimizing the turnaround with data

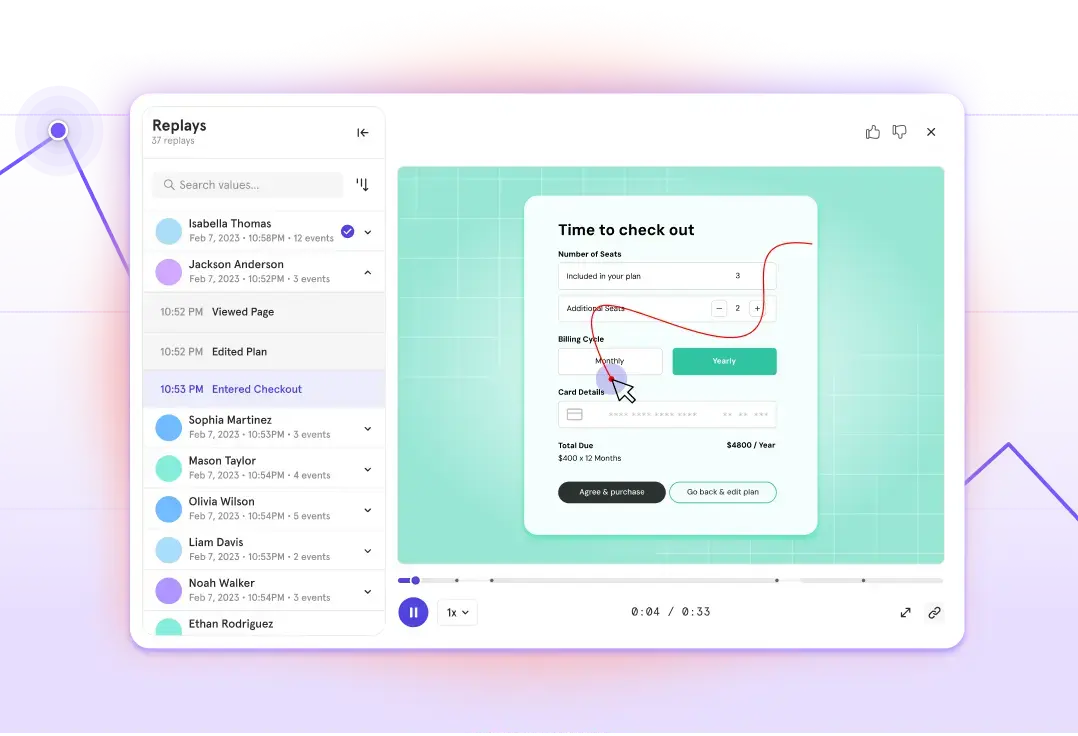

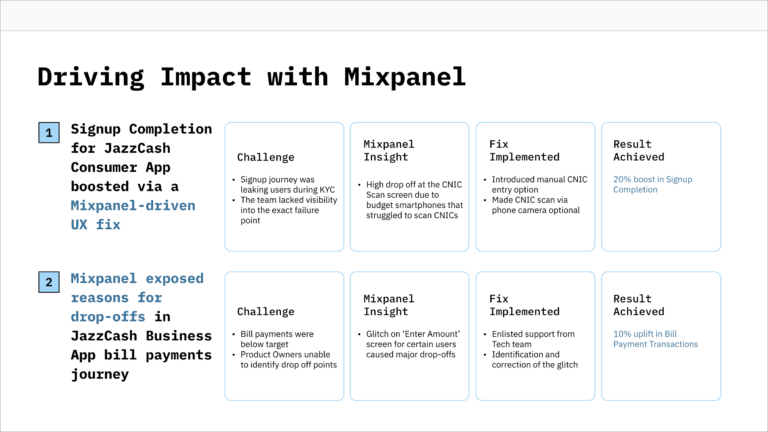

Our data and analytics capability also became a force multiplier. As customer acquisition became more complex, due to evolving KYC requirements and other regulatory processes, we needed to ensure that every interaction was optimized. Using a platform like Mixpanel, we identified pain points in real time. For example, after noticing a sharp drop-off in sign-ups due to difficulties scanning national ID cards, we introduced a manual entry option that immediately improved completion rates by 20%.

In another case, we uncovered a glitch in the bill payment flow of our business app. Product owners were initially unable to identify the cause. Upon further analysis in Mixpanel, we discovered a glitch on the “Enter Amount” screen for certain users. We delivered a quick fix for this and saw a 10% uplift in bill payment transactions. This ability to continuously optimize our conversion rates is at the heart of our success.

Transformation is a journey

All of this reinforces a singular truth: transformation isn’t a moment, it’s a journey. It took us eight years to build an ecosystem that could deliver sustained impact. Navigating internal change, external shocks, and rapidly shifting customer expectations was essential. We acquired merchants, scaled technology, empowered our teams, and responded to crises. There were no shortcuts, only persistence, focus, and the willingness to adapt.

Looking back, our story is about building a digital platform that understands its users deeply, delivers value consistently, and evolves with purpose. That’s the future we continue to build at JazzCash.