How Joyn prioritized the user experience to drive subscriptions and ad revenue

Company

Joyn is a fast growing entertainment streaming platform whose vision is to become the home for streamers, joining people in their daily lives. Joyn’s mission is to provide its users with personalized streaming content tailored to their situation, mood and device. Joyn offers a variety of services: free viewing, registered viewing and subscription. This means its revenue model is split between subscription and ad revenue. Users are able to watch live TV channels as well as on-demand series, documentaries, films, sport and other content from a number of partners bundled into one platform. Subscribers get access to all of this as well as exclusives and originals.

Challenge

Joyn had always championed a culture of data democratization. But they realized this was leading to the wrong use of data—justifying individual opinions, instead of utilizing insights to move forward together. The user journey and user behavior is at the heart of every decision at Joyn, so they needed to shift this culture for more collaborative decision-making.

Solution

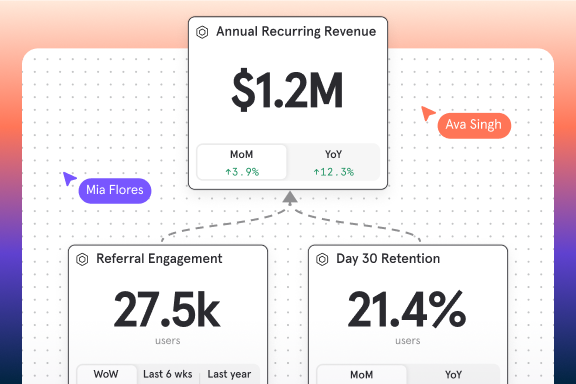

Joyn introduced Mixpanel as a tool with access to all of the company’s data. Mixpanel is used throughout the company—whether that means marketing, content editors, product, engineering, CRM and more. It’s embedded into the daily workflows of every team. Across the spectrum, users utilize Mixpanel to ask the right questions and experiment from product changes to customer communications and marketing. Joyn’s unique approach to its data infrastructure means it can link all of this data to ask even deeper cross functional questions.

Results

- Introduced on-demand channels that drove a high single digit increase in watch time

- Enabled experimentation and launching different options to different user cohorts

- Provided tools to access company-wide data to product teams, engineers, content editors, content acquisition teams, CRM, customer support and marketing

How they did it

What led you to Mixpanel?

To explain why Mixpanel has become so crucial to Joyn, it’s important to first establish that we don’t use it for any reporting on advertisements or video playback. That’s because of the kind of numbers we’re talking about here—we have multiple million active users—and it’s simply not feasible.

What we are interested in analyzing is user journeys, cohorts, funnels and flows. It’s critical for us to understand things like content performance (what worked, what didn’t work), which pathway on the product worked for specific users, the activating content discovery structure for different cohorts of users and how many people convert from search versus browse behaviors.

Like any aggregator, we don’t have a single dominant flow, instead we have multiple flows to the same piece of content. Knowledge of different journeys is mission critical, and this is what led to our daily use of Mixpanel.

Do you have an example of using Mixpanel to measure and test content pathways with different user cohorts?

We’ve made a number of changes to the product recently using insights from our use of Mixpanel. One example is changing the number of ‘cards’ visible on the homepage. For our ‘hero’ content on the homepage, we historically chose three cards but we now use five. On top of this, we have a new structure where in addition to scrolling through cards on a carousel, users can select a thumbnail to go into more detail.

These are not changes we blindly rolled out. We used Mixpanel to enable experimentation, rolling out different options to different user cohorts to understand the result, before settling on five as the right number of cards.

We also experiment with content positioning using Mixpanel based on the right mix of promotion and personalisation for a user. Unlike some of our competitors, we have dozens of content partners as well as our parent company’s content. We have to land on the right mix of what the user will prefer and what we want to promote.

You mention how important understanding user behavior is at Joyn. How widespread is your use of Mixpanel as a result?

Part of our success lies in standardizing on Mixpanel as our analytics tool of choice across the company. Mixpanel is used by product teams, engineers, content editors, content acquisition teams, CRM, customer support and marketing.

It’s not a situation where only product people or user researchers are familiar with the tool—from our perspective that’s missing an opportunity.

We do have super users, and this small group make up 50% of the queries, however there’s a wide population that understand event flows and use the tool to enhance decision making during their daily work.

Part of our success lies in investment of both time and effort in having as wide a cohort of users as possible across the company. Mixpanel is used by product teams, engineers, content editors, content acquisition teams, CRM, customer support and marketing.Deepak Alse SVP Product Management & Data Strategy, Seven One Entertainment Group

Please explain how content editors leverage their understanding of the user experience using Mixpanel.

This is a very interesting use case. In the past, editors had their own dashboards, but once we realized the importance of Mixpanel, we doubled down on building specific dashboards tailored to their role.

Editors primarily use the tool to change what content gets placed on the platform and its position within a certain ‘lane’ (a row of content) on a certain page—this is known as windowing. The goal here is placing content in a position that will result in maximum activation.

It’s important to explain how Joyn operates as we have three distinct types of users: anonymous viewing (we are one of the few products on the market that still offers viewing without registering), people who have registered, and subscribers.

In the content world, windowing is a very important part of any strategy. And it’s not the same for each user group or even users within the same groups. Certain shows are for subscribers only, for example.

It’s a tough job for the editors, who need to answer questions like: “I put this show in the hero lane in this position between 5 and 6pm. Did this lead to traffic converting? And if so, did playback requests lead to 5, 10, 20 minute or 1 hour views?”

It’s a constant art of A/B testing and refinement in terms of editing, approach and strategy for the different groups. That’s why editors are in our top three user groups alongside product and marketing.

How is your marketing team deriving value from the tool?

Our marketing teams use Mixpanel for a variety of functions, but all center around gaining a better understanding of our users. We do a lot of funnel analysis, such as channel breakdowns via Mixpanel (e.g organic versus ad generated). We also analyze where incoming traffic leads and which activities are helping us achieve activation at the top of the funnel.

It’s a lot of performance marketing, which is driven around whether a particular channel and path generates better ad revenue and retention for us.

More broadly, it gives us directional clarity, or a sanity check on our hypotheses.

What’s different about the way you use Mixpanel?

Joyn is unique in that we’ve moved away from using third party CDP’s (Customer Data Platforms), and we now manage most of our events in our own hierarchy. We also have our own SDK (Software Development Kit). This means that we can define events in both the front and back end.

This affords a fully fledged view, allowing us to compare CRM inputs with product data for example. Let’s say we send a marketing email to a specific group of users. We can then measure how many of that cohort watched a certain number of video playbacks, which generate ad revenue for us. If it worked, we’ll then send the communication out to a wider cohort, iterating as we go based on performance.

While a lot of companies invest effort in front end analysis, this hybrid model allows us to bring together more events in one source. Crucially, we only measure data in this way for users who have consented.

How have you achieved a data informed culture?

We’ve always spoken about the importance of data democratization at Joyn. But this also led to unintended consequences. It weaponized data by encouraging people to find charts that backed up their opinions, and this slowed overall decision making.

So, we made a decision to drop the data democratization language. Instead we simply introduced Mixpanel as a tool where all our data was available. And, it’s accessible, meaning people don’t need to ask for permission or be added. Everyone has the option for access and training (though this is mandated in certain teams) from the moment they are onboarded.

We’ve developed an internal playbook on Mixpanel, but we also have an open invitation on our “Mixpanel help slack channel” for help with queries because we recognize that individually we’re not going to be the best at every use case. There are certain queries that the editorial team are just going to be more familiar with, or marketing, product, engineering and so on.

What’s also important is making sure that everybody knows this is not a tool for simply putting together weekly metric reports on department KPI’s. That can be useful, but it misses a lot of the value. Mixpanel is for informed decision making.

For example, it can help us answer questions like: “Should we launch this?” “Why should we launch this?” “What’s the behavioral pattern of cohort X compared to cohort Y?” “What does this tell us?”

To truly maximize benefit, you need to be asking the right questions and using the insights properly. We de-weaponized data by making it less about “was I right or wrong?” and more about asking good questions.

What’s an example of a good question you’ve personally asked with Mixpanel?

One question we’ve been interested in for a long time is why people spend more time in certain parts of the product even if they’re not the most dominant or visible. For example, identifying users who only watch live TV and not on-demand.

Using Mixpanel we realized that live TV is the most friction free part of the experience for a new user. To watch on-demand content, you have to scroll through a catalog and bookmark shows. Let’s say you’re on a train mid-commute to the office, you won’t have time to do this and watch an entire episode.

In comparison, live TV is much easier. You have a recognizable channel name and it’s easy, casual, low-barrier viewing even if it’s not our most interesting content.

So, we’ve introduced ‘On-demand channels’ which is a faster version of the catalog with curation of some of our high value content.

In this example, we used Mixpanel to understand why our users like live channels, and the changes we made led to high single-digit growth in watch time.

Thousands of companies use Mixpanel to build better products. See what Mixpanel can do for your team. Create your free account today.