Singapore eCommerce fashion and lifestyle platform, Zalora, uses Mixpanel to drive conversion and better understand experimentation results

Company

Zalora is Asia’s leading online fashion, beauty, and lifestyle destination. As one of the region’s pioneer large-scale eCommerce platforms, Zalora has established a strong presence, enjoying over 50 million visits per month. With an extensive collection of over 3,000 top international and local brands, shoppers can find all the things they love in one place. Customers can discover authentic products across a variety of categories, from apparel, shoes, accessories, beauty, pre-loved, and lifestyle, which include essentials and home & living products.

Challenge

Having used Google Analytics 360 (GA360) for the past decade, Zalora was struggling with getting insightful and actionable data from the session-based analytics tool. Zalora needed an event-based analytics tool that could follow a user across their purchase journey and help them deeply understand their users. They also needed an analytics tool that could easily integrate with other downstream tools they were using for engagement and experimentation.

Solution

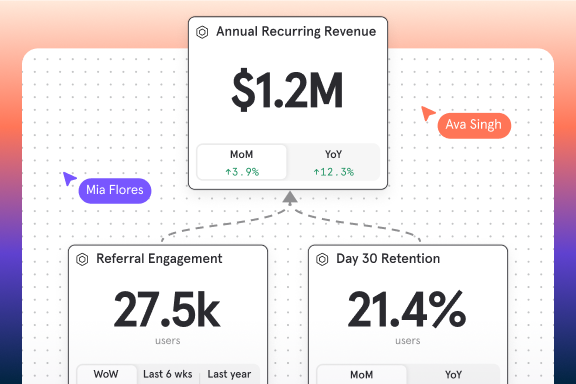

In 2022, Zalora onboarded Mixpanel to provide important data insights to help them prioritize their product roadmap, deeply understand user behavior, and run better experiments. By using Mixpanel, they were able to make data-driven decisions across the company and understand what exactly drives conversion.

Results

- Improved conversion

- Higher engagement in catalog and product listing pages

- Increased efficiency and deeper analysis when running experiments

- Data-driven decision making

We used to spend a lot of time debating subjective opinions and ideas. With Mixpanel, we can simply let the data do the talking.May Chin Head of Product, Zalora

How they did it

What were the problems you were experiencing?

We had several challenges:

- We lacked access to truly insightful and actionable data through GA360 which we were using for over a decade at that point. GA360 is inherently session-based, which means it’s really difficult to follow a user from A to Z across their purchase journey. Even the simplest of analytics questions would take hours of manual exports, custom queries, and reconciliation. For example, a basic retention analysis of how many users who made a first-time purchase came back 10 days later and then added a product to their wishlist, can’t be done on GA360.

- When it came to the technical aspect, there was a lot of wasted development effort, because we were integrated with GA360 directly. For every new event we wanted to track, we would then need to re-architect and implement it separately for all of our downstream platforms.

- There was the imminent deprecation of GA360 to GA4. We wanted to explore GA4 alternatives, so we took the opportunity to do a full reevaluation from scratch to arrive at the analytics tool that truly meets our use cases the best.

How did you learn about Mixpanel?

Most team members were loosely aware of the main players in the event-based analytics space, so Mixpanel was always top of mind for us. In addition, one of us experienced using Mixpanel in 2016 while working for an Edutech company based in Malaysia. We decided to do a more thorough evaluation since Mixpanel’s name kept coming up.

How did you evaluate Mixpanel and other competing solutions?

We compared Mixpanel with several other solutions like Amplitude and GA4 and ran an in-depth evaluation. The three main evaluation criteria were:

- Use case analysis – We came up with a list of 40 to 50 use cases after a series of in-depth cross-departmental interviews. This consists of very specific analytics use cases that need to be answered, ranging from mundane day-to-day analytics problems to more complex insights that we believe could be valuable for us to grow as a company.

- Qualitative analysis – We identified several subjective factors that are equally, if not more, important than our use cases. This includes working dynamics between each team and the vendors; the level of support we received; the look and feel of the tool; and product vision and roadmap because we wanted to make sure that our vendor’s company vision would be aligned with ours.

- Pricing analysis – We compared the pricing models across all of these vendors: how effective the unit economics of each pricing model was; how efficient it would be; which gave the most attractive pricing; and which provided the least concern when it came to overage costs.

Why did you choose Mixpanel?

One specific use case that stood out was Mixpanel’s cohort-building feature. The cohort-building capabilities integrated nicely with all our downstream CRM tools, so we’re not just able to generate the insights, but also take action on it through engagement tools like Braze. We also really like the ability to build nested cohorts that none of the other vendors were able to do.

Mixpanel shone through as a best-in-class analytics platform with its deep feature set. Everything was thoughtfully designed and impactful in our day-to-day to help us prioritize our product roadmap, get deep insights from our experiments, and better understand our users and what drives them to convert. Their user-friendly interface also helped some of our less analytics-savvy team members wrap their heads around using an analytics tool.

You mentioned that many different teams were involved in the evaluation process. What teams use Mixpanel today?

Almost every team in Zalora uses Mixpanel. Of course, buying Mixpanel was a Product-driven decision and the product team has always been the number one evangelist. But now we have expanded usage internally across multiple departments. Users now span the majority of analytics-facing departments at Zalora such as Pricing, Revenue, Marketing, Onsite, CRM, Operations, Product, and Commercial. Even our engineering team has started using Mixpanel more to monitor the performance of app releases or even do impact sizing of certain bugs in production. We’re seeing a very healthy and diverse adoption of Mixpanel within the company.

Mixpanel has also imbued in us a newfound understanding and knowledge of what exactly drives conversion in Zalora…we are able to make much more informed judgments on how we structure our strategies in our day-to-day operations.May Chin Head of Product, Zalora

How did you drive the adoption of Mixpanel within your organization?

It’s not easy to change company culture from never looking at numbers for a whole decade, due to how cumbersome GA360 was, to a data-driven one. To facilitate change management, we used a decentralized approach and established Mixpanel evangelists throughout the organization. We nominated one to three key individuals across each department to act as their team’s internal Mixpanel expert, to support the onboarding process and help spread knowledge to their respective teams.

What are some best practices you can share with companies who are also looking to grow analytics adoption?

There is no silver bullet to adoption, and the journey never ends. It’s an ongoing process of motivating wider teams to keep analytics at the forefront of whatever they do. Even to this day, my team spends around 10% to 20% of our week on driving adoption. We ensure that all relevant materials like training recordings and documentation on how to use Mixpanel are prepared and easily accessible. We’ve even created a set of kick-starter dashboards on Mixpanel which contain all the main events and properties that we use. Any new joiner can easily click through each report, inspect the methodology, and get a quick bird’s eye view of how to use Mixpanel and what the most important data points are. This enables them to hit the ground running and start using Mixpanel right away.

Please elaborate on how you are using Mixpanel.

Here are some of our key use cases:

- Analysis of which funnel areas or features we should be devoting more focus to because it is underperforming relative to other areas of our product.

- A less obvious benefit that we found to be highly impactful is the sheer number of ideas and hypotheses that we are able to invalidate upfront thanks to Mixpanel. For example, we would have a certain feature idea that we think makes perfect sense, but upon digging into the analytics, we realized that user behaviors could be contrary to whatever assumption we initially held. Since the data shows us that we’re not likely to be on the right path, we save time and engineering effort by making the decision upfront not to pursue the idea.

- Mixpanel supports our experimentation efforts through the integration with our experimentation tool, Optimizely. We are now able to instantly go into Mixpanel, and with a few clicks immediately build cohorts of users who are exposed to a particular variant of a particular experiment. With Mixpanel, we are able to add more color and context to our experiment performance and augment whatever analyses we are doing on the experimentation front with secondary metrics and leading indicators. For example, we launched an experiment where we created a higher density of sponsored products within our product listing page. We found that the variant was underperforming but we didn’t know why. When we dived into Mixpanel, we found that users were specifically avoiding clicking on the area where these sponsored products were displayed, and they were also engaging much less with pagination. This helped us gain a key insight, which was the higher the density of sponsored products, the lower the engagement in our overall catalog or product listing page.

What additional benefits have you gained from using Mixpanel?

There is a lot less subjective debate. We used to spend a lot of time debating subjective opinions and ideas. With Mixpanel, we can simply let the data do the talking.

Mixpanel has also imbued in us a newfound understanding and knowledge of what exactly drives conversion in Zalora. Conversion rate can be such a nebulous metric because there are so many factors contributing to it. But with Mixpanel, we have a much better understanding of the various sub-drivers and levers that affect conversion rates. We are now able to confidently answer questions on how these factors correlate with conversion rate:

- Length of our product description on our product detail page

- Number of photos we’re displaying per product

- Volume of ratings and reviews

- Level of discounting we are doing per product per brand

- Number of promo codes we have per SKU and more

You might be surprised we weren’t able to answer all that before we had Mixpanel. But now we are able to make much more informed judgments on how we structure our strategies in our day-to-day operations.

Mixpanel has cultivated strong relationships and has well-maintained integrations with the other tools we are using, making them more compatible with the vision we had for our overall technology stack.May Chin Head of Product, Zalora

How are you leveraging Mixpanel’s best-of-breed partners?

We are using Segment as our CDP, Braze for messaging, and Optimizely for experiments. I’ve already shared how we are using Optimizely above.

Segment has helped us cut down on duplicate development efforts. We don’t directly integrate our product with Mixpanel, but instead, we use Segment to funnel our data to all our downstream vendors including Mixpanel. This cuts down a lot of mental and technical effort needed to track a new event. Before Segment, we had to do it separately for every vendor, but now we only need to do it once. With Segment and Mixpanel, it has become a lot easier for us to achieve full tracking coverage of all the data points that truly matter to us.

Our marketing team also uses Mixpanel with Segment Reverse ETL to attribute revenue to specific banner clicks on our home page.

With Braze, we utilize the integration with Mixpanel to build complex custom cohorts for targeting on Braze. Recently we had a major bug in production. We were able to instantly build a cohort on Mixpanel for all users who were affected, send it over to Braze, and award them with cashback compensation. All of this took a matter of minutes. In the past, this would have taken us 1-3 hours to set up.

What advice do you have for someone evaluating an analytics tool?

Here’s our advice:

- Hone in and narrow your focus to the use cases that really matter to you. There are plenty of tools out there with hundreds of different features. Instead of getting blinded and swayed by all the fancy features out there, take a step back and ask yourself: Would this actually be something useful in our day-to-day? Do these really address the burning questions and problems that we are facing now or are these just superficial features that are nice to have? That’s why it was so impactful for us to start with the use case checklist created from the bottom up instead of evaluating a tool from the top down. Always stay grounded in reality and focus on what is truly the problem right now.

- Gravitate towards a vendor that has a compatible product vision with yours. For example, we really like that Mixpanel has a very clear product vision to go deep into analytics and focus solely on that. On the other hand, there are other analytics vendors that are trying to expand to more diverse use cases like AB testing, personalization, and even push notifications, which then inadvertently harm their relationships with other best-of-breed partners. This will be bad for us because we are also users of those partners and we need their integrations to be well-maintained. Mixpanel has cultivated strong relationships and has well-maintained integrations with the other tools we are using, making them more compatible with the vision we had for our overall technology stack.

What’s next for your company? How will you use Mixpanel in the future?

We want to further drive analytics to be at the heart of every decision we make in the company, which isn’t necessarily the case right now, across all departments. That’s really where we’re trying to get to. We are making every new employee undergo a Mixpanel training, to ensure that everyone is analytics-savvy, and for them to leverage analytics on Mixpanel as their first instinct whenever doubt creeps up during decision-making. At the moment we have 200 to 250 internal Weekly Active Users on Mixpanel, but we really want to get to the 500 to 600 range.