What is customer retention?

Customer retention is the ability of a company to keep its existing customers over a specified period. It measures how successful a business is at satisfying customers, delivering ongoing value, and building lasting relationships. High customer retention rates directly correlate with increased customer lifetime value, reduced acquisition costs, and sustainable business growth.

No matter how much water you pour into a leaky bucket, it will never be full. At the very best, you’ll be stalling the inevitable. But it’s still an exercise in futility.

Building a product on customer acquisition without dedicating time, budget, or effort to customer retention is the same: You might keep enough momentum to grow for a while. But at the end of the day, you’re still filling a leaky bucket.

Improving customer retention is fixing the bucket, so that the water (or really, your customers) remains. Higher retention rates mean lower acquisition costs, higher customer lifetime value (LTV), and sustainable growth. It's no coincidence that retention analysis is one of the most important Mixpanel use cases for our customers.

Let’s talk about customer retention, how to calculate it, why it matters, and how to improve it.

What is customer retention?

Customer retention is the ability a company has to retain existing customers. The opposite of retention is churn, or when customers leave your product.

Retention is evaluated slightly differently for different industries and business models:

Ecommerce companies will measure the number of customers who return to make a purchase within a specific timeframe, while SaaS companies will look at the number of users who continue renewing their subscription (and they will probably distinguish between free and paid retention if they use a free trial or freemium model).

A social media platform like Facebook or Instagram might use logins to track retention.

The details vary, but the core principle is the same: Businesses want to keep customers for as long as possible. Measuring and understanding retention rates is the key to making that happen.

Why is customer retention important?

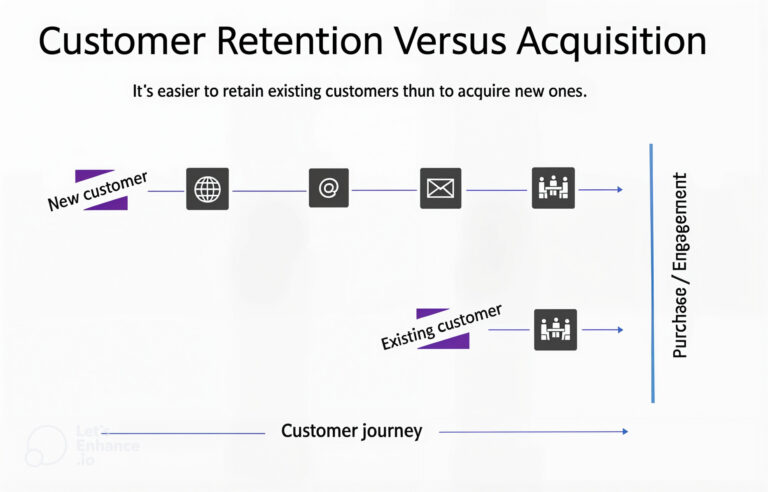

Customer retention is a low-hanging fruit for company growth. Retention requires less effort and often has a much higher dollar-for-dollar payoff than acquiring a new customer.

Customer retention efforts also pay dividends. Bain & Company found that a mere 5% increase in customer retention could lead to a 25% to 95% increase in overall revenue.

Loyal customers who know and like your brand are more likely to try new products and tend to spend more per purchase. Reaching customers with whom you already have an established relationship also requires less effort. They already like you, understand the value you provide, and have chosen to buy from or engage with you. They might subscribe to your newsletter or follow you on social media. This makes their customer journey brief and simple.

While you can’t completely replace acquisition with retention—new customers must come from somewhere—a customer retention strategy can make you far more profitable.

Retention vs. acquisition: Where to focus

The short answer is, you need both.

Acquiring new customers helps combat churn. Even companies with high-performing retention strategies will experience some inevitable churn. Bringing in new customers helps maintain a steady (or ideally, growing) customer base. Targeting new customer segments or markets is also a proven strategy to increase revenue, especially if sales in your current market are dwindling.

Having and retaining loyal customers is also an advantage in difficult market conditions when customers are less likely to take the risk of testing new products or switching from existing brands.

Retained users who engage with your product over a longer period of time also give you valuable insights into product usage, which you can analyze with the right digital analytics platform.

Despite the advantages of a strong retention strategy, many companies still focus more heavily on new customer acquisition. Adding brand new customers is exciting, and these activities often receive the lion’s share of attention, budget, and resources. Companies also tend to overestimate their ability to retain customers naturally through customer service. According to Forbes, they dramatically overrate their customer service performance:

- 80% of companies rated their customer service as superior

- 8% of customers rated companies’ customer service as superior

Companies that believe they provide excellent service tend not to invest in it as much (since they don’t believe they need to), which leads to poor customer experiences and low retention. According to Qualtrics, as much as $3.7 trillion of sales worldwide were at risk from bad customer experiences in 2024.

As many as 97 percent of customers who churn do so without providing feedback. With a digital analytics platform you can skip the guesswork and see precisely what factors lead to churn, test solutions, and increase customer retention.

The customer retention formula

To calculate your retention rate, you need three numbers:

- The number of customers at the start of X period

- The number of customers at the end of X period

- The number of customers acquired during X period

You can measure your customer retention by plugging those numbers into the customer retention equation:

((E-N)/S) × 100 = Customer Retention Rate

Where:

- E = Number of customers at the end of the period

- N = Number of new customers acquired during the period

- S = Number of customers at the start of the period

Or if you prefer:

((# of customers at end of period – # of customers acquired during period) / # of customers at start of period ) x 100 = Customer Retention Rate

For example, if you had 120 customers at the end of the period, 104 at the beginning, and acquired 20 during that time, your equation would look like this:

((120 – 20) / 104) x 100 = 96% customer retention rate

It’s useful to understand where retention numbers come from, but calculating retention manually is a chore, and it leaves the door open for human error. Tools like Mixpanel’s Retention Report are designed to automatically assess retention over a specified period.

The Retention Report can answer questions like:

- On average, how many users are still active two weeks after signing up?

- What percent of all users are still doing X after seven days?

- How has my 7-day retention changed over time?

- What percent of users did X in 2, 3, or 4 distinct hours of the day?

For example, the “virtual living room” app Kast used Mixpanel’s Retention Report to help them identify and understand stickiness indicators. They started looking at Week 1, Week 4, and Week 12 retention queries in Mixpanel, which helped them realize that customers build a relationship with their product over longer periods, days, or even weeks. These insights helped them nurture those relationships for longer and user retention increased by over 50%.

Read the full case study to learn more.

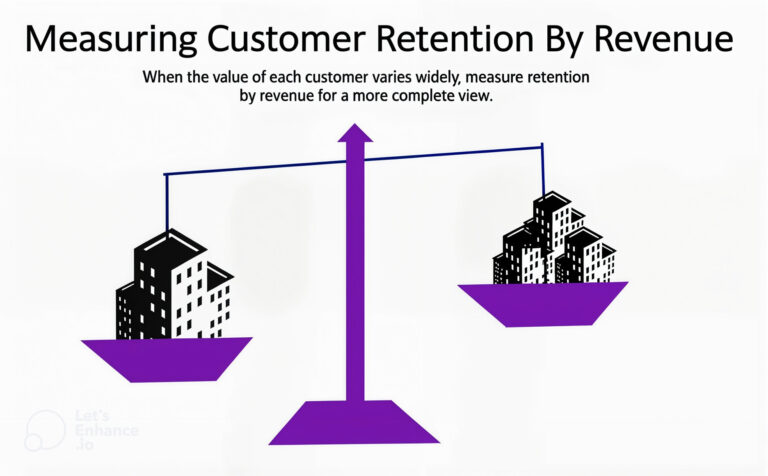

Calculating customer retention by revenue

The equation above shows how to calculate retention by total customers, but there are also other variables you can use. If the dollar value of each of your customers greatly varies, it may make more sense to measure retention by revenue.

For example, a software company has a handful of large, high-paying clients and a lot of small, low-paying ones. The impact of retaining five small clients might be very slight compared to retaining the same number of big clients. You can highlight this difference by measuring retention by revenue.

If you wish to calculate your customer retention by revenue, simply use the equation above and substitute the term “number of customers” for “revenue.” It is possible for your customer retention rate to be over 100 percent if you’re measuring it by revenue.

Unlike measuring by number of customers, where each customer can only ever be worth “1,” your current customers can grow in revenue. They can go from being worth “1” at the start of the period to being worth “1.2” or even “2” by the end. When this customer base growth more than offsets any losses from churn, you end up with a number over 100 percent.

What’s a good customer retention rate?

The answer to that question will depend heavily on your industry, company, and revenue model. A dating app might aim for a low retention rate and “good churn” because its users leave once they find what they’re looking for, whereas a financial services app might have an incredibly high retention rate because banking services are sticky.

Customer retention benchmarks by industry

Benchmark your retention rates against your own past performance and competitors in your industry. Tracking how you measure up against yourself is fairly straightforward: The right digital analytics platform can help you measure progress over time and compare different periods, cohorts, and user behaviors to see how your customer retention rates evolve.

Benchmarking against competitors is trickier and requires more research, but that’s where Mixpanel can help: Our 2024 Benchmarks Report compares retention rates across different industries, including Financial Services, Media & Entertainment, Ecommerce, Technology, Healthcare, and Gaming.

Here are a few highlights:

- Retention rates fell across all industries. In 2023, the average week-one retention rate across industries fell from 50% to 28%.

- Financial Services saw the biggest contraction in YoY week one retention—a 24% drop—from 51% to 27%

- Gaming was the smallest drop, though still a sizable step back, going from 26% to 12% retention

Another retention metric that PMs are paying close attention to is product stickiness (usually measured by calculating the DAU/MAU ratio).

Download our Benchmarks Report to learn more about retention rates in your industry.

How digital analytics platforms help improve retention

A powerful customer retention strategy is at least as important as customer acquisition, but too many companies neglect retention until it becomes a problem—and it’s much harder to bail out a sinking ship than it is to build a sound vessel in the first place.

The best way to prevent a crisis is to track and optimize your product for retention from the start. And the easiest way to do that is digital analytics. Digital analytics platforms can help you understand your customers and unlock insights into the full user journey so that you can see exactly where users are dropping off and improve retention before it becomes a problem.

One of the most powerful tools to improve retention is cohort analytics: Separating your users into groups that share common characteristics, like demographics or behavior allows you to track their interactions with your product over time. Cohort analysis can help you offer different groups more personalized experiences and analyze the behaviors that correlate with higher engagement to nudge more users toward those behaviors.

Behavioral segmentation helps you identify at-risk customers and engage them before they churn. You can measure the impact of new features and make changes to your UX or roadmap accordingly, giving more customers what they want. Most importantly, digital analytics gives you real-time insights that you can use to make faster retention-focused decisions.

How Scrambly boosted customer retention with digital analytics

As a rapidly growing company in a highly competitive industry, Scrambly needed to optimize its acquisition strategy while maintaining strong retention rates. According to CEO Alexander Grankin, “In our industry, user acquisition is incredibly expensive, and retention is everything. We needed to make aggressive, data-driven product choices—and the only way to do that was to have instant access to the right data.”

Scrambly leveraged Mixpanel’s event-based tracking to find an early indicator of user retention and lifetime value (LTV). This helped them optimize paid campaigns beyond basic signup tracking.

“We needed an event that happened early in the user journey but was a strong predictor of long-term retention. Using Mixpanel, we found a key event within an hour and a half—and this completely changed our marketing strategy. Google Ads campaigns started performing significantly better, and our acquisition costs dropped substantially”, notes Grankin.

With those changes, Scrambly was able to increase onboarding completion by 20% and optimize $500k+ in monthly ad spend.

Read the full case study to learn more.

FAQ

What is a good customer retention rate?

This depends on your industry. Check out our Benchmarks Report to see how you stack up to the competition.

Why is customer retention important?

Customer retention is key for company growth. If you don’t retain customers, even the most effective customer acquisition strategies will lead to churn and a decreased customer base down the line.

How do you calculate customer retention rate?

The formula for customer retention is ((# of customers at end of period – # of customers acquired during period) / # of customers at start of period ) x 100. Calculating retention manually increases the risk of error—tools like Mixpanel’s Retention Report automatically track retention rates.

What's the difference between customer retention and customer loyalty?

Customer retention measures whether users continue using your product over time (with metrics like week-1 retention, 30-day retention, etc). Customer loyalty looks at how engaged your customers are with your product. Loyalty goes beyond retention: Loyal customers are more likely to advocate for your product and recommend it to others, which helps with growth.